Advertisement|Remove ads.

Waaree Renewable Shares Surge To Record High On Robust Q2 Results

Shares of Waaree Renewable Technologies surged 13.6% to a record high on Monday after the clean energy firm posted strong Q2 results.

Waaree Group’s renewable energy arm reported a strong set of numbers for the second quarter of FY26, with net profit soaring 117.4% to ₹116.34 crore, compared to ₹53.52 crore in the same period last year.

Revenue from operations rose 47.7% to ₹774.78 crore, driven by order executions and steady inflows. EBITDA more than doubled to ₹157.9 crore from ₹71.6 crore, while margins expanded sharply to 20.39% from 13.65%.

“India’s solar EPC sector is also rapidly evolving and our integrated capabilities place us at the forefront of this transformation. With a robust solar EPC unexecuted orderbook of 3.48 GWp, we are strategically positioned to execute large-scale, integrated energy projects and lead India’s energy transition by serving value across the lifecycle from design and delivery to commissioning and O&M. Further, the company is also building substation and transmission line for specific solar power project,” said Manmohan Sharma, CFO, Waaree Renewable Technologies.

Order Book Details

The company’s unexecuted order book stood at 3.48 GWp (giga-watt peak), expected to be delivered over the next 12–15 months, supported by a healthy bidding pipeline exceeding 27 GWp.

During the quarter, Waaree Renewable Technologies secured new solar project orders worth about 1.25 GWp and approved a capex budget to set up two 14 MWp IPP solar power plants in Maharashtra and a 37.5 MWp IPP solar project in Rajasthan.

Trading Call

SEBI-registered analyst Vishal Trehan believes Waaree Renewables is a good stock among its peers and is available at a lower P/E. Its fast growth with good margin stability and positive operational cashflows, along with policy tailwinds, make it a worthy candidate for staggered accumulation, especially on dips around ₹1,000, where it is making its current price base

Waaree Renewables has a return on capital employed (ROCE) of 82.3 and a return on equity (ROE) of 65.6, while trading at a P/E ratio of 36.9, noted SEBI-registered analyst Ashok Kumar Aggarwal.

Technical indicators are positive. The relative strength index (RSI) is above 60, while the Chande Momentum Oscillator (CMO), a momentum indicator, is above +25, the analyst observed.

The on-balance volume (OBV) is rising on both daily and weekly charts, signaling strength, momentum, and accumulation, he added.

For the short to mid-term, Aggarwal recommends accumulation in the ₹1,200 - ₹1,235 range, with a stop loss at ₹1,175 and potential targets between ₹1,300 and ₹1,425.

What Is The Retail Mood?

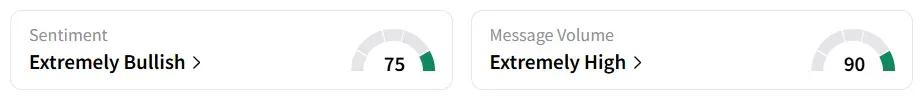

Retail sentiment on Stocktwits shifted to ‘extremely bullish’ after the results. It was ‘bullish’ a session earlier. Chatter on the platform was ‘extremely high’.

The stock has gained for the past three consecutive sessions, adding 23.5%.

Overall, the company has seen strong buying interest this year, gaining over 40%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)