Advertisement|Remove ads.

Wall Street Enthusiasm On Celsius’ Near-Term Prospects Cools, But Retail Sees Buying Opportunity

- Piper Sandler cited only modest inventory reduction for the Celsius brand as part of its more cautious outlook.

- KeyBanc analyst Christopher Carril initiated coverage of the stock with a ‘Sector Weight’ rating.

- Carril suggested that the near-term upside for Celsius shares may be limited despite its strong year-to-date performance.

Celsius Holdings Inc. (CELH) saw its price target trimmed by Piper Sandler on Wednesday as the firm sees modest inventory reductions for the energy drink brand even as sales momentum remains steady into late 2025.

The adjustment comes as the firm keeps an ‘Overweight’ rating while moderating expectations amid ongoing distribution changes.

Growth Outlook

Piper Sandler reduced its price target to $61 from $69, noting that the company’s latest sales pace appears to remain solid through the fourth quarter of 2025, and shipments of Alani Nu products may be exceeding sell-through expectations.

The firm cited only modest inventory reduction for the Celsius brand as part of its more cautious outlook.

Celsius’ stock traded 3% lower mid-morning on Wednesday. In a separate update, KeyBanc analyst Christopher Carril initiated coverage of the stock with a ‘Sector Weight’ rating, suggesting the near-term upside for Celsius shares may be limited despite its strong year-to-date performance.

Carril pointed to integration challenges, including the shift of Alani Nu into the PepsiCo (PEP) distribution network, as a factor that may constrain gains until those adjustments settle.

Celsius recently moved Alani Nu into PepsiCo’s system, a shift expected to broaden shelf reach but also introduce complexities in execution.

What Are Stocktwits Users Saying?

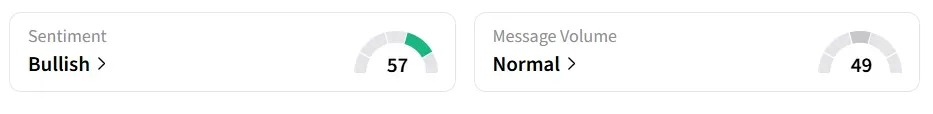

On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘bearish’ territory the previous day. Message volume changed to ‘normal’ from ‘low’ levels in 24 hours.

A bullish Stocktwits user said they are loading up on the shares at a discount.

Another user noted Monster Energy was the top performing stock after the tech bubble, suggesting confidence.

CELH stock has 58% year-to-date.

Also See: Why Did Vistagen Stock Tank 82% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)