Advertisement|Remove ads.

Walmart CEO Doug McMillon Sells $1.9M Shares, Continuing Small Divestitures

Walmart (WMT) President and CEO Doug McMillon has sold company shares worth $1.86 million, according to a filing with the Securities and Exchange Commission on Monday.

He offloaded 19,416 shares at an average price of $95.58 last Thursday. The share sale is part of a previously approved Rule 10b5-1 trading plan.

Following the transaction, McMillon directly owns 4,412,397 shares and indirectly owns 1,059,678 shares through various trusts and 401(k) plans.

According to reports, McMillon has been selling shares routinely this year. He has sold an average $2.7 million worth of Walmart shares each month from January through May.

While executives often sell stock routinely, frequent or large sales could signal a possible lack of confidence in the company's future stock performance.

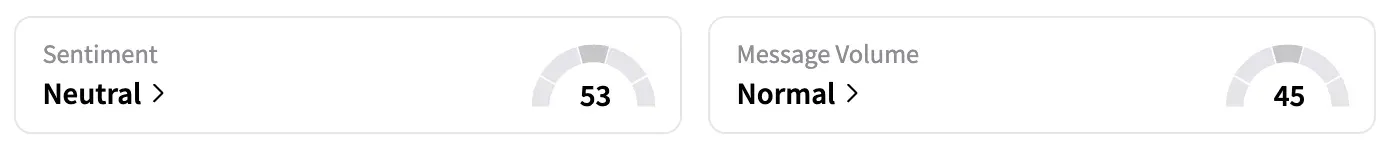

On Stocktwits, the retail sentiment for Walmart shifted to 'neutral' as of late Monday, from 'bullish' the previous day. So far this year, Walmart shares have gained 8%, compared to the 8.7% rise in SPDR S&P 500 ETF (SPY), which tracks S&P 500 stocks.

McMillon's share sale comes at a turbulent time for America's largest retail chain. In May, the company announced plans to raise product prices in its stores, citing economic pressures, prompting similar moves from rival retailers.

That same month, Walmart unveiled a broad corporate restructuring plan involving the reduction of approximately 1,500 roles in the U.S., primarily across its technology, operations, marketing, and fulfillment teams, and the reorganization of select warehouse assets.

President Donald Trump's tariffs have introduced significant uncertainty into the market, driving up input costs for companies and altering consumer shopping patterns, among other impacts.

Earlier this month, Reuters reported that some of Walmart's suppliers have delayed or put on hold some orders from garment manufacturers in Bangladesh, in response to President Donald Trump's plan to impose a 35% import tariff on the key textile hub.

For the last quarter, Walmart reported revenue and profit above expectations, but withheld a profit forecast for the ongoing second quarter, citing economic and demand unpredictability.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: P&G Taps Insider Shailesh Jejurikar As Next CEO — Jon Moeller To Move To Executive Chairman Role

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)