Advertisement|Remove ads.

Walmart CEO Flags Higher Costs As Tariffs Go Into Place: ‘We See More Adjustments In Middle- And Lower-Income Households’

Walmart (WMT) CEO Doug McMillon said during the post-earnings call on Thursday that the costs are increasing each week as the company replenishes inventory at post-tariff price levels.

McMillon added that the company expects the cost increases to continue into the third and fourth quarters. “Not surprisingly, we see more adjustments in middle- and lower-income households than we do with higher income households,” McMillon said.

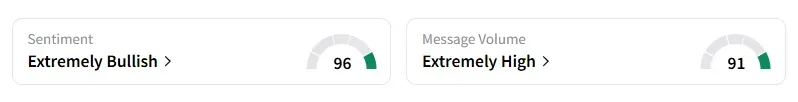

Retail sentiment on Walmart improved to ‘extremely bullish’ from ‘bullish’ territory a day ago, with message volumes at ‘extremely high’ levels, according to data from Stocktwits.

Shares of Walmart were down 3% in premarket trading. The retailer’s adjusted earnings per share (EPS) came in at $0.68, compared with Wall Street expectations of $0.74, according to data compiled by Fiscal AI.

“Third-quarter operating income is expected to be in the range of 3% to 6%. This guidance reflects a wide range of outcomes than our prior approach, which we believe is prudent given the ongoing trade policy discussions, a demand backdrop that remains somewhat, and a desire to maintain flexibility to invest for share gains,” CFO John David Rainey said.

Rainey added that the impact on margins and earnings from higher costs of goods and how it flows through the retailer’s inventory will be “less pronounced than previously anticipated.”

Walmart forecast its annual sales to rise between 3.75% and 4.75%, compared with the previous expectation of a 3% to 4% growth. The company now expects adjusted earnings per share (EPS) between $2.52 and $2.62, up from the prior forecast of $2.50 to $2.60.

The retailer’s second-quarter revenue came in at $177.40 billion, compared with estimates of $176.38 billion. Walmart stock has gained 13.5% so far this year and jumped over 32% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Just In: McCormick To Acquire Additional 25% Ownership In Mexico Joint Venture

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246131051_jpg_78a656bc06.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)