Advertisement|Remove ads.

Walmart Sells Stake In JD.com To Raise $3.6 Billion: Here’s What Retail Is Thinking

Retail giant Walmart Inc (WMT) sold its stake in Chinese e-commerce player JD.com (JD) to raise about $3.6 billion, unloading 144.5 million shares for $24.95 per unit, Bloomberg reported. Following the development, shares of JD.com listed in Hong Kong plunged over 8% on Wednesday.

According to the report, Walmart is revamping its strategy in China where retail players have been struggling to improve performance in a weak economy. With the stake sale, Walmart has ended a partnership that began in 2016 when it acquired a 5% stake in the firm.

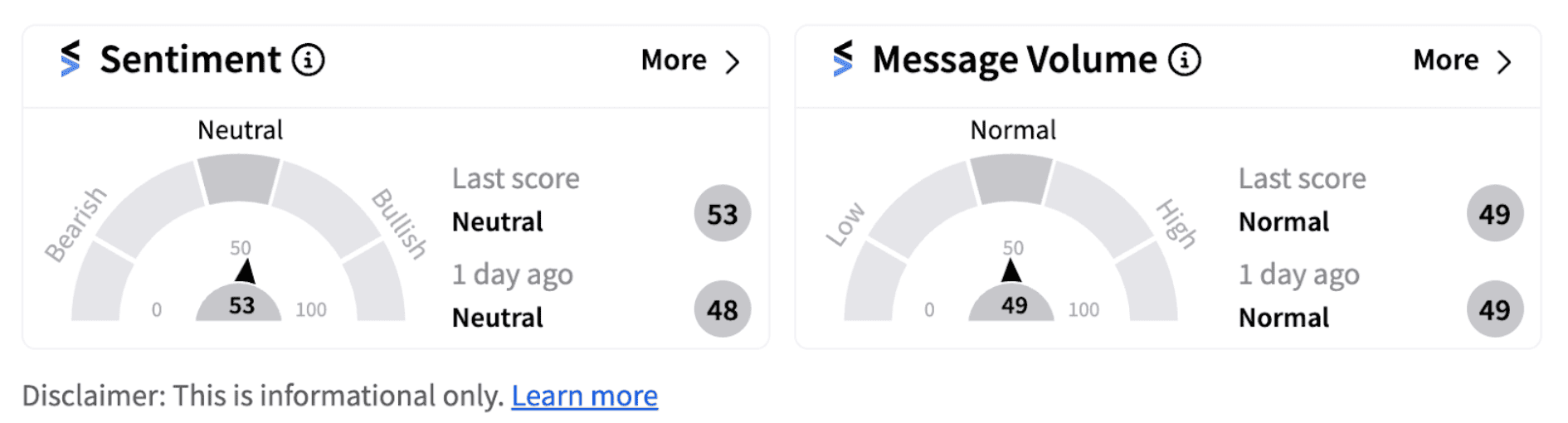

Retail sentiment on Stocktwits remained in ‘neutral’ territory albeit at a higher score (53/100) than from a day ago.

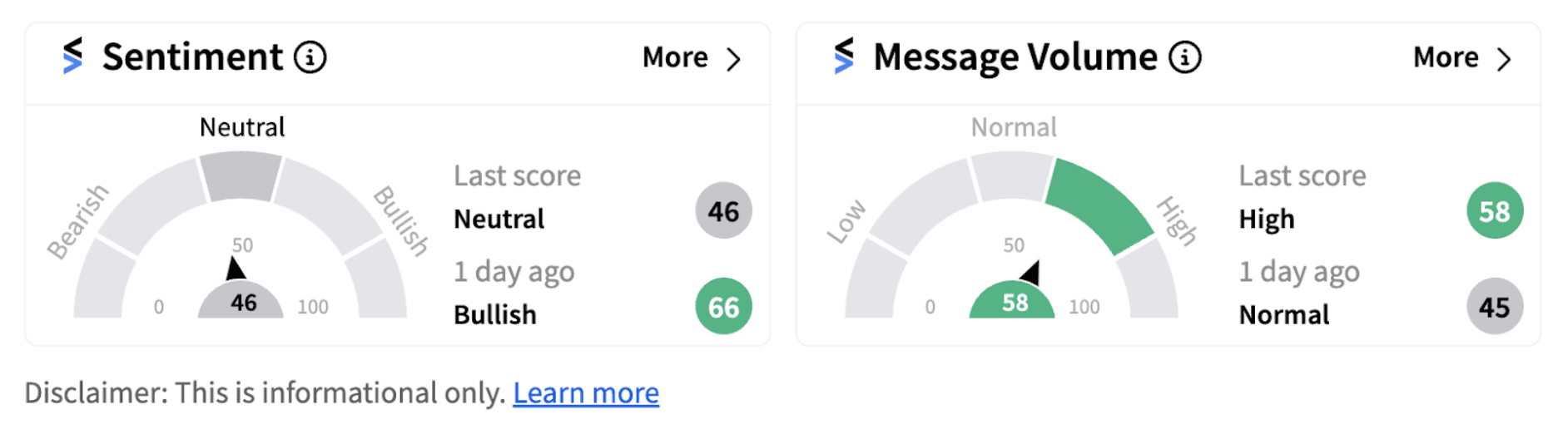

Meanwhile, JD.com has also bought back $390 million worth of its shares today. Retail sentiment on the Chinese firm has dipped into the ‘neutral’ territory (46/100) from ‘bullish’ a day ago.

The report further quoted Walmart saying the sale will allow the firm to “better focus on the country’s strong development” and “allocate funds to other priorities”. Walmart also stated it will continue to cooperate with the Chinese retailer.

Walmart’s latest earnings and revenue topped Wall Street estimates and the firm also raised its full-year guidance. Second-quarter revenue rose 4.7% year-over-year (YoY) to $169.34 billion versus an estimate of $167.38 billion while earnings came in at $0.67 compared to an estimate of $0.65. Net income, however, declined 43% YoY to $4.5 billion.

The company now expects full-year net sales to increase 3.75% to 4.75% compared to a marginal increase from the original estimate of a 3% to 4% rise. Adjusted operating income is expected to increase 6.50% to 8.00%. Earlier, Walmart had projected the growth rate to inch toward the high-end or slightly over the original guidance increase of 4.00% to 6.00%.

Walmart shares are up nearly 1% in Wednesday’s pre-market trading. Some Stocktwits users believe the retailer may have waited too long to sell the stake in JD.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)