Advertisement|Remove ads.

Warner Bros Stock Rises On Report Of Bids From Comcast, Netflix, And Paramount

- Paramount Skydance, Comcast, and Netflix are preparing to bid for Warner Bros. Discovery, the Wall Street Journal reported.

- WBD shares gain in the premarket session, along with Comcast’s; Netflix stock drops.

- Warner Bros. has reportedly asked interested parties to submit their bids by Nov. 20.

Warner Bros. Discovery, Inc.’s share jumped by 3.6% in early premarket hours on Friday following a Wall Street Journal report saying that media giants Paramount Skydance, Comcast, and Netflix are preparing to bid for the company.

Netflix’s shares declined 0.3%, while those of Comcast, which owns the NBC TV network, MSNBC news network, and Universal Pictures, gained 0.4%.

This comes after Warner Bros. Discovery reportedly rejected a $60 billion offer from Paramount Skydance last month. It said at the time that it had initiated a review of strategic alternatives “in light of unsolicited interest the Company has received from multiple parties for both the entire company and Warner Bros.”

Bidding War

WBD is now holding an auction process and has set a deadline of Nov. 20 for interested parties to submit non-binding bids, the WSJ reported, citing unnamed sources.

Paramount intends to participate in the formal auction process and remains committed to buying the entire company, according to the report. Comcast and Netflix are chiefly eyeing Warner Bros.’ film and TV studios along with the HBO Max streaming platform, while showing little interest in the company’s cable assets, such as CNN, TNT, and the Discovery Channel.

The bidding process comes as Warner Bros. moves forward with a previously announced organizational split. By next year, WBD would be split into two companies: one to house its studios and streaming businesses and the other comprising its cable networks.

Retail Stays Neutral For Now

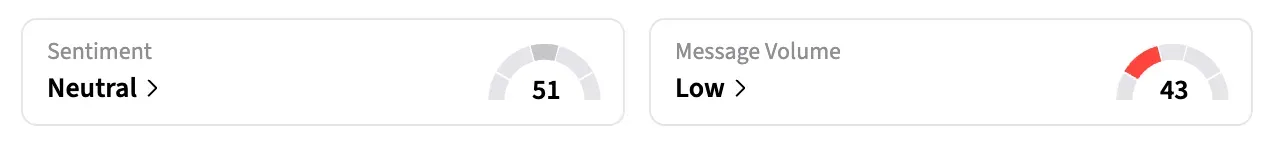

On Stocktwits, the retail sentiment for WBD shifted to ‘neutral’ as of early Friday, from ‘bearish’ the previous day.

“$WBD remember my words a lot more than 30$. My guess 40$ fierce battle,” a user said, referring to the potential offer price for the deal.

WBD stock closed at $22.14 on Thursday, giving the company a market capitalization of $54.9 billion. Shares have more than doubled over this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)