Advertisement|Remove ads.

Warren Buffett's Berkshire Substantially Reduces Stake In Apple, Bank of America In Q3: Here's How Retail Feels About These 2 Stocks

Warren Buffett-led Berkshire Hathaway ($BRK-A) ($BRK-B) on Saturday disclosed in its 10-Q filed with the SEC for the third quarter that it has notably pared stakes in Apple, Inc. ($AAPL) and Bank of America Corp. ($BAC) - two of its core portfolio equity holdings.

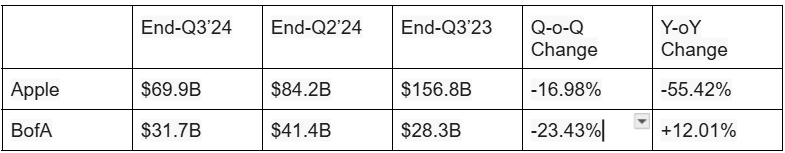

Here’s how Berkshire’s holdings changed:

In terms of number of shares, Berkshire has reduced its Apple holding by 25% since the second quarter, CNBC reported.

At Berkshire’s annual shareholders meeting held in early May, Buffett attributed his decision to dispose of Apple's shares to the need to hold cash amid the uncertainties. He also suggested that the proceeds were to foot the federal tax bill. He ruled out any change in his investment thesis toward Apple.

At the end of the third quarter, Berkshire's cash position topped $300 billion for the first time.

Apple reported last week an earnings beat for the fourth quarter but softer-than-expected Services revenue, a tax charge that dented net income and lukewarm guidance for the key holiday quarter weighed down on the stock.

Berkshire has been trimming its BofA position since mid-July.

Retail Mixed

Amid Berkshire’s Apple liquidation, retail sentiment was mixed.

On Stocktwits, an user said the move is not negative for Apple as Berkshire’s approach is conventional. He expects Apple stock to recover from its current level. Apple ended Friday’s session down 1.33% to $222.91.

Another, however, opined that future growth rates just cannot support Apple stock price.

https://stocktwits.com/dennismccain/message/591058835

Retail sentiment toward BofA was also mixed. A Stocktwits user premised his optimism on his positive outlook for the banking industry.

Another expressed apprehension over potential enforcement action. The bank said last week that U.S. regulators are probing its processing of payments through the Zelle network.

Related Link: Berkshire Q3 Operating Income Dips, Cash Position Swells To $325B, Retail Sentiment Mixed

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)