Advertisement|Remove ads.

UnitedHealth Group’s Stock Falls Pre-Market As Higher Medical Costs Eat Into Profits: Here’s How Retail Is Reacting

Shares of UnitedHealth Group, Inc. ($UNH) dropped nearly 4% pre-market on Tuesday, placing the stock among the top three trending symbols on Stocktwits.

The healthcare giant reported Q3 earnings, revealing a higher-than-expected rise in medical-care costs, which pressured profits, and lowered its full-year outlook.

The stock was the worst performer among the Dow Jones Industrial Average components as of 7:00 am ET.

UnitedHealth’s medical-care ratio (MCR)—the percentage of premium dollars spent on medical services increased to 85.2% from 82.3%. This surpassed FactSet’s consensus estimate of 84.4%.

“Among factors contributing to the increase were the previously noted CMS Medicare funding reductions, medical reserve development effects and business and member mix,” UnitedHealth said.

The company also trimmed the top end of its full-year profit guidance, now expecting adjusted earnings between $27.50 to $27.75 per share for 2024, down from the earlier range of $27.50 to $28.00 per share.

That includes a projected 75-cent-per-share hit due to business disruption caused by a February cyberattack on Change Healthcare, a key player in healthcare billing systems.

Health insurers across the U.S. have reportedly faced rising medical costs and lower payments from government programs in recent months.

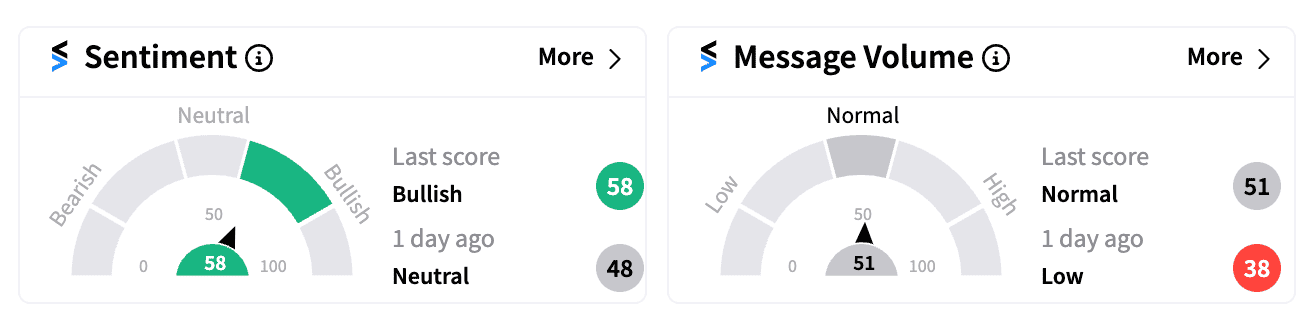

Still, retail sentiment for UNH on Stocktwits was ‘bullish’ early on Tuesday, with some investors focusing on the positives, including the company’s revenue and profit beat.

UnitedHealth posted Q3 revenue of $100.8 billion, beating analysts’ expectations of $99.2 billion, while adjusted earnings per share came in at $7.15, ahead of the $6.99 estimate.

Year to date, UNH’s stock has gained 15%, outpacing the Health Care Select Sector SPDR ETF ($XLV), which is up 13.5%, but lagging behind the S&P 500’s 22.9% rally.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)