Advertisement|Remove ads.

Wedbush Stresses Need For Positive Tech News This Week As US Trade Talks Intensify: Retail Downbeat Ahead Of Alphabet, Intel, TI Earnings

Technology stocks have been under pressure over the past few weeks after President Donald Trump announced steep 'reciprocal tariffs' on U.S. trading partners earlier this month.

The risk-off mood is despite the president pausing tariff implementation for 90 days to provide leeway for bilateral trade negotiations.

Against the backdrop, Wedbush analyst Daniel Ives said time is ticking for trade deals and that the economy and the technology sector need "good news" this week.

Specifically, the analyst called for establishing a negotiation path with China, given the country is one of the major supply bases for the U.S.-headquartered tech giants.

Ives said the damage is self-inflicted, but there is still much confusion ahead. The analyst also noted that tech earnings season is imminent, with expectations of minimal or no guidance due to a lack of visibility into customers' growth and spending plans.

Nvidia stock reflected the risk of the impasse as it shed 8.5% last week after the company disclosed $5.5 billion in charges related to additional China chip curbs by the Trump administration.

Ives believed the Street is now baking in about a 10% cut to 2025 numbers across the board.

If the negotiations do not commence shortly, the analyst expects the trade war to inflict significant damage to growth and stir up inflation. This, the analyst said, will leave the tech world with "many questions and no answers to plan their future strategy."

Last week, ASML Holdings, Inc. (ASML) kickstarted things for the sector by reporting a sharp drop in net bookings. Key among the tech earnings slated for the week are:

Tuesday:

- SAP SE (SAP)

Wednesday

- International Business Machines Corp. (IBM)

- Lam Research Corp. (LRCX)

- ServiceNow, Inc. (NOW)

- Texas Instruments, Inc. (TXN)

Thursday

- Mobileye Global, Inc. (MBLY)

- STMicroelectronics N.V. (STM)

- Alphabet, Inc. (GOOG) (GOOGL)

- Intel Corp. (INTC)

- Verisign, Inc. (VRSN)

Retail sentiment toward technology stocks remained downbeat, with the sentiment meter reading 35/100 for the Invesco QQQ Trust (QQQ) exchange-traded fund (ETF). The message volume was 'normal.'

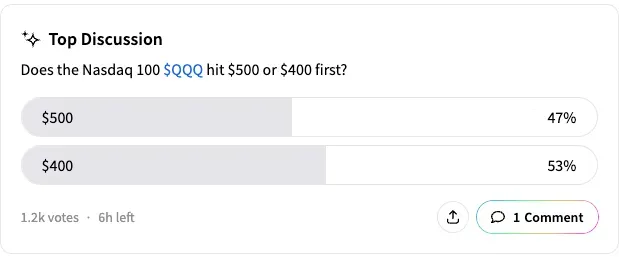

An ongoing Stocktwits poll that asked users where the QQQ ETF will hit $500 or $400 first found that 53% of the 1,200 respondents predicted a down move toward $400.

The market's tariff obsession is evident from the sharply lower Nasdaq 100 futures despite Netflix, Inc.'s (NFLX) earnings beat.

The QQQ edged down 0.03% at $444.06, with the ETF down about 13% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: DocuSign Stock In Spotlight On Expanded Cognizant Partnership: Retail Stays Positive

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)