Advertisement|Remove ads.

Wells Fargo Upgrades iRhythm Technologies Stock, Raises Price Target To $130: Retail’s Thrilled

Shares of iRhythm Technologies, Inc. (IRTC) traded 21% higher on Friday afternoon after Wells Fargo upgraded the stock to ‘Overweight’ from ‘Equal Weight’, a day after it provided full-year guidance that exceeded Wall Street expectations.

Wells Fargo also raised its price target on the stock to $130 from $104, as per TheFly. The new price target implies a 19.7% upside to IRTC’s closing price on Thursday.

Wells Fargo believes that strong volume growth for iRhythm’s Zio AT device and good progress with value-based care accounts, among other factors, support the upside to iRhythm's guidance in 2025. iRhythm’s Zio AT device enables mobile cardiac telemetry (MCT) monitoring service.

Baird also raised its price target on iRhythm to $150 from $133 while keeping an ‘Outperform’ rating on the shares.

iRhythm Technologies on Thursday reported revenue of $158.7 million, a 20.3% increase compared to the first quarter of 2024. This increase was driven by momentum from innovative value-based care accounts, demand from Zio AT in the United States, and record demand in the United Kingdom.

Adjusted loss per share came in at $0.95, compared to a loss of $1.23 per share recorded in the same period in 2024.

iRhythm now expects revenue for 2025 to be between $690 million and $700 million, above an analyst estimate of $686.79 million, per Finchat data. The company also expects adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin for 2025 to range from approximately 7.5% to 8.5% of revenues.

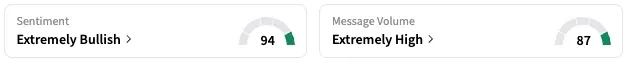

On Stocktwits, retail sentiment around IRTC jumped from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘low’ to ‘extremely high’ levels.

IRTC stock is up by about 47% this year and 18% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)