Advertisement|Remove ads.

Wells Fargo Calls S&P Global, Moody’s Selloff ‘Unwarranted’ After FactSet’s Dour Forecast

Wells Fargo analysts said that Thursday’s selloff among financial data provider stocks was unwarranted due to limited overlap.

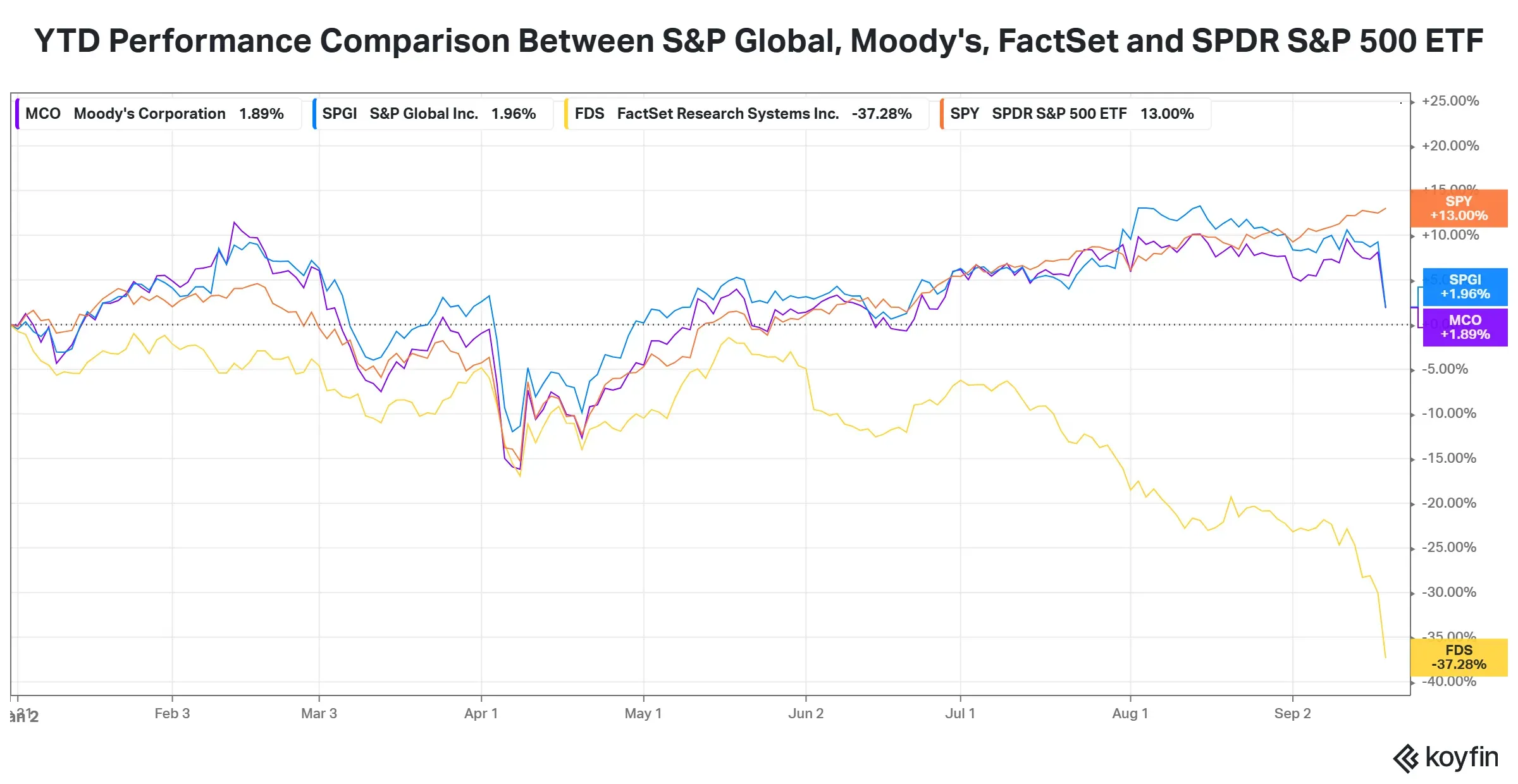

S&P Global and Moody’s stock fell 6.7% and 5.8%, respectively, during the regular trading session. All three stocks logged their worst day since the Trump tariff-driven market turmoil in April.

The declines came after FactSet reported its annual adjusted earnings below Wall Street’s estimates, amid concerns over a slowdown in client spending and increased competition in the sector. FactSet projected its 2026 adjusted earnings between $16.90 and $17.60, while analysts projected earnings of $18.26 per share. The stock slumped nearly 11% on Thursday.

“We’re taking a conservative approach to our guidance to reflect the current environment of longer sales cycles and more rigorous client approval processes,” Chief Financial Officer Helen Shan said, before noting that the company remains confident about its competitive position and market demand.

According to TheFly, Wells Fargo cut the firm's price target on FactSet to $355 from $296 and maintained an ‘Underweight’ rating on the shares. The brokerage noted that FactSet’s outlook seemed conservative and its upbeat annual subscription value was overshadowed by mention of rising competition due to AI and margin pressures from increased investments.

“There is a lot of competitive dynamics, as in new competitors, startups, and traditional competitors, all in an AI arms race,” CEO Sanoke Viswanathan said.

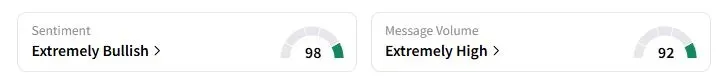

Retail sentiment on Stocktwits about FactSet and S&P Global was still in the ‘extremely bullish’ territory at the time of writing, while traders were ‘bullish’ about Moody’s.

“If you're here to buy and hold for 3-5 years or more. It is good to start [a] position here at small tranches,” one user said about S&P Global.

“On valuations, it has plummeted to a ratio last seen during the 2008 crash as well. This could be an exceptional buy if you believe that its platform is sticky and that recent earnings weakness is temporary,” another user said about FactSet.

S&P Global, Moody’s, and FactSet stocks have all underperformed the broader markets this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)