Advertisement|Remove ads.

Western Union Launches International Money Transfer Services With Penny Pinch: Retail Sentiment Hits Year-High

Western Union Co (WU) shares were in the spotlight on Wednesday after launching international money transfer services with Eastern Caribbean’s digital wallet provider Penny Pinch. The firm also reported its fourth-quarter and full-year earnings on Tuesday.

Shares of Western Union traded over 2% higher Wednesday morning.

Western Union launched money transfer services on the Penny Pinch app. Customers can now receive money in their wallets through Western Union’s global network, which spans over 200 countries and territories.

Users will also be able to send funds to bank accounts and mobile wallets worldwide and pick up cash at locations abroad. Penny Pinch customers can also earn cashback and rewards from retailers, access exclusive coupons, and make cashless payments.

Meanwhile, Western Union reported a 1% year-over-year (YoY) rise in its fourth-quarter revenues to $1.058 billion compared to a Wall Street estimate of $1.03 billion.

Revenue was driven by growth in Consumer Services and Branded Digital, with results including a lower contribution from Iraq compared to the prior year period, which negatively impacted the revenue growth rate by three percentage points.

Net income rose 203% year-over-year (YoY) to $385.7 million. Adjusted earnings per share (EPS) came in at $0.40 versus an analyst estimate of $0.42.

The firm’s Consumer Money Transfer (CMT) segment revenue decreased 4% on a reported basis and was flat on an adjusted basis. Branded Digital revenue rose 7%, and Consumer Services segment revenue grew 56% on a reported basis.

For 2025, Western Union expects adjusted revenue of $4.115 billion to $4.215 billion compared to a Wall Street estimate of $4.162 billion. EPS is expected to come in at $1.75 to $1.85 versus an analyst estimate of $1.79. The company expects an operating margin of 19% to 21%.

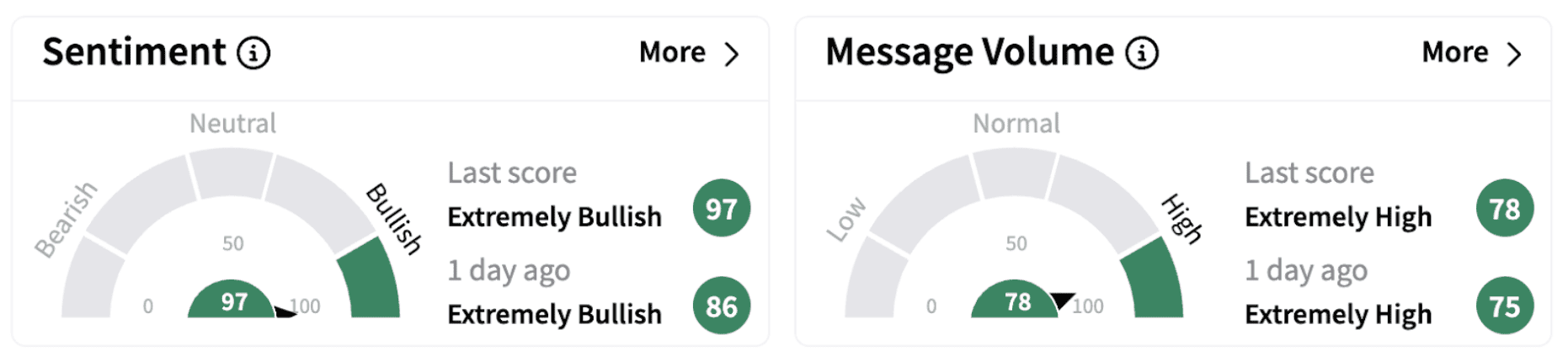

On Stocktwits, retail sentiment climbed into the ‘extremely bullish’ territory (97/100), hitting a one-year high, accompanied by ‘extremely high’ message volume.

A Stocktwits user anticipates Western Union’s share price will rise due to buybacks.

WU shares have gained over 1.5% in 2025 but have lost over 14% over the past year.

Also See: Trump Tariff Uncertainty: Morgan Stanley Dials Down Fed Rate Cut Expectations To Just One This Year

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)