Advertisement|Remove ads.

Trump Tariff Uncertainty: Morgan Stanley Dials Down Fed Rate Cut Expectations To Just One This Year

With no clear indication of U.S. tariff decisions, Morgan Stanley now expects only one rate cut worth 25 basis points in 2025 compared to its previous view of two rate reductions through the year.

A Morgan Stanley research note said imposing tariffs more quickly than assumed would likely mean disinflation halts at a higher pace of inflation, blocking any near-term path to cuts.

“Even if tariffs are avoided, we think their potential keeps uncertainty about PCE inflation elevated and keeps risks to PCE inflation tilted to the upside. We now only look for one rate cut this year in June. The path for monetary policy in 2025 remains highly uncertain,” the note stated.

After announcing tariffs on China, Mexico, and Canada, the Trump administration halted its decision on two countries. Currently, tariffs on Mexico and Canada have been delayed 30 days, although the incremental 10% tariff on China has taken effect.

“While the immediate worst case for markets may have passed, trade policy uncertainty

remains high and, in our view, means the hurdle rate for Fed rate cuts has risen. As a

result, we remove our forecasted rate cut for March and leave only one 25bp rate cut this

year at the June meeting,” Morgan Stanley said.

The note also highlighted that the uncertainty surrounding the tariffs is likely to amplify the views expressed by the Federal Reserve at its December meeting when most FOMC members were concerned about greater uncertainty regarding the personal consumption expenditures (PCE) inflation and saw risks to PCE inflation as tilted to the upside.

The December personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred gauge of inflation, continued to trend above the central bank’s targeted levels.

According to data by the Bureau of Economic Analysis, PCE rose 2.6% on a year-over-year (YoY) basis in December. The reading stands 0.2 percentage points higher than the November figure but aligns with expectations.

Core PCE index, which excludes food and energy and is considered as a better gauge of long-term inflation, increased 2.8% from a year ago, again in line with expectations.

“That uncertainty and upside risk have arrived more quickly than we anticipated,” Morgan Stanley said.

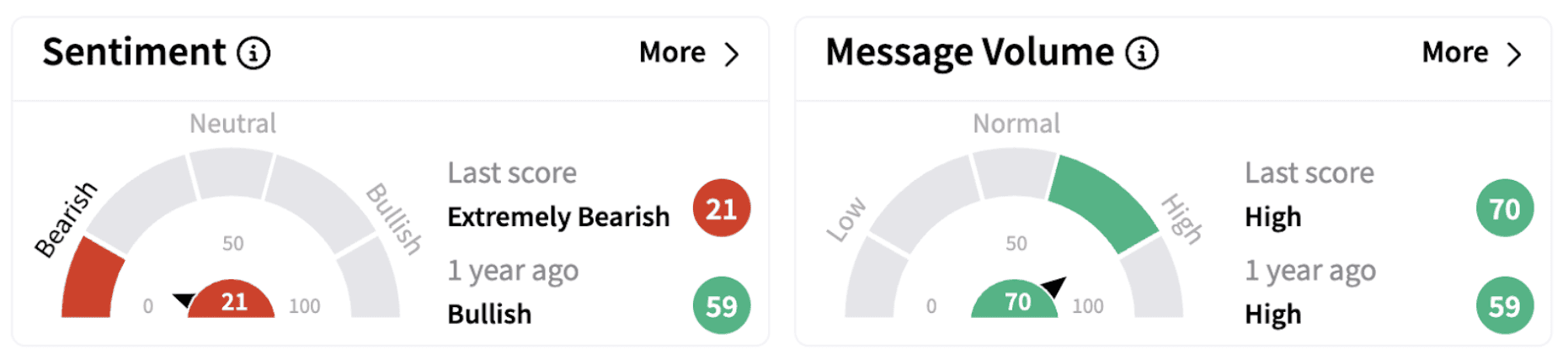

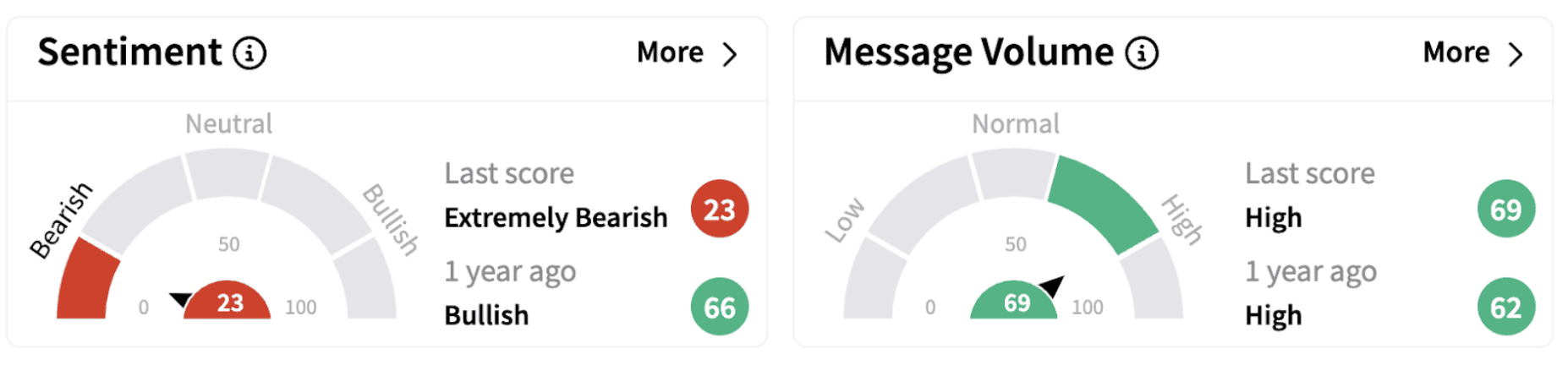

Meanwhile, major Wall Street indices have continued to wobble over the last five days. The SPDR S&P 500 ETF Trust (SPY) has lost over 0.5%, while the Invesco QQQ Trust, Series 1 (QQQ) declined 0.24% in the period. On Stocktwits, retail sentiment for both these ETFs trends in the ‘extremely bearish’ territory.

Morgan Stanley believes that heading into 2025, President Trump would start with narrow tariffs on China, while Mexico & Canada would likely be able to stave off implementation by offering policy concessions.

“…we still expect the US will levy more tariffs on China later this year as part of its larger trade policy goals, though we’ll be watching carefully to see if this particular event reveals anything about the US reaction function on trade policy that could change our thinking.,” Morgan Stanley noted.

Also See: Uber Stock Stumbles As Soft Guidance Eclipses Q4 Beat, But Retail Confidence Soars To Year-High

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)