Advertisement|Remove ads.

Why Alibaba Stock Is Soaring Over 9% Premarket Today

Alibaba's U.S.-listed shares jumped over 9% in early premarket trading on Wednesday, following news from its annual flagship Cloud event in China about its plan to increase artificial intelligence (AI) investment beyond its previous commitments.

Alibaba Group CEO Eddie Wu said the company will increase spending on AI models and infrastructure development, in addition to the 380 billion yuan ($53 billion) over three years that Alibaba announced in February.

“We are vigorously advancing a three-year, 380 billion [yuan] AI infrastructure initiative with plans to sustain and further increase our investment according to our strategic vision in anticipation of the [artificial superintelligence] era,” Wu said, according to a CNBC report.

Alibaba Cloud also announced that its Platform for AI (PAI) will integrate the full Nvidia Physical AI software stack, providing developers with cloud-based tools to accelerate work in humanoid robotics and physical AI applications.

Earlier in the day, the Chinese tech giant unveiled Qwen3-Max, its largest AI model to date, with a capacity to process 1 trillion parameters, and a slew of other AI updates.

Alibaba's Hong Kong shares were up 9.6%, hitting nearing a four-year high, just before the close of trading on the Hong Kong Stock Exchange.

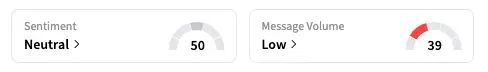

On Stocktwits, the retail sentiment for BABA shifted to 'neutral' as of early Wednesday U.S. time, from 'bearish' the previous day, with the ticker among the top trending symbols on the platform.

As of last close, BABA stock is up 35.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Wendy's Retail Investors Optimistic Despite Stock Hovering Near 5-Year Low After Analyst Downgrade

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)