Advertisement|Remove ads.

Wendy's Retail Investors Optimistic Despite Stock Hovering Near 5-Year Low After Analyst Downgrade

Retail watchers for Wendy's Co. were unfazed amid the acute weakness in the restaurant chain’s stock and a recent downgrade on Wall Street, signaling expectations of a bounce back.

Research firm Argus downgraded the stock to 'Hold' from 'Buy' on Tuesday, citing softness in the fast-food chain's U.S. business. Analysts argued that while the valuation appears appealing, the company faces rising costs, a leadership transition, and intense competition.

Last month, Wendy's reported a 2% rise in second-quarter revenue, although its U.S. sales declined 3%. International business performed better, with sales increasing by 9%.

Meanwhile, Wendy's stock has fallen nearly 14% since hitting a recent high on Aug. 18, and now hovers just above the low last seen in March 2020.

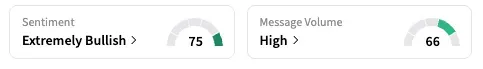

However, on Stocktwits, the retail sentiment for WEN has remained in the 'extremely bullish' zone, unchanged over the current week, and 24-hour message volume jumped over 250%.

"$WEN Well, this trade isn't going the way I thought it would. Added again, still long," a bullish user said.

Candy major Hershey poached Kirk Tanner, Wendy's former CEO, last month, and the fast-food chain is looking for a replacement. Wendy's shares are down 44.2% year-to-date.

Currently, 20 of the 29 analysts covering the stock rate it 'Hold,' six rate it 'Buy' or higher, and three rate it 'Sell' or 'Strong Sell,' according to Koyfin data. Their average price target is $11.56, implying a 30% upside.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Opendoor Stock’s Retail Trader Confidence Drops Amid Share Slide As Major Holder Slashes Stake

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)