Advertisement|Remove ads.

Why Are KHC Shares Down Almost 5% After-Hours On Tuesday?

- The prospectus supplement has been filed in relation to amended and restated registration rights as of July 2, 2015, the company said in its filing with the SEC.

- The company said that the prospectus supplement about the potential resale of stock does not guarantee that Berkshire Hathaway will sell its shares.

- Berkshire Hathaway has so far remained Kraft Heinz’s largest shareholder since the merger in 2015.

Shares of Kraft Heinz Co. (KHC) slid 4.88% in Tuesday’s after-market hours following the company’s filing of a prospectus supplement about the potential resale of stock by Berkshire Hathaway.

As per a filing with the U.S. Securities and Exchange Commission (SEC), Berkshire Hathaway (BRK.A) could potentially sell up to 325,442,152 shares of KHC’s common stock at a par value of $0.01 per share.

Sale Disclosure

The prospectus supplement has been filed in relation to amended and restated registration rights as of July 2, 2015, the company said in the filing.

However, the registration does not guarantee that Berkshire Hathaway will sell the shares, Kraft Heinz added. However, if the sale does go through, Kraft Heinz will not receive any of the proceeds and will pay certain expenses of the registration of the shares.

Berkshire Hathaway has so far remained Kraft Heinz’s largest shareholder since the company coupled with 3G Capital in 2015 to merge Kraft Foods and H.J. Heinz. Warren Buffett’s firm held a 27.5% stake in the company as of 2025.

In September 2025, Kraft Heinz announced that the company will split in two, with one part housing its brands like Heinz, Philadelphia and Kraft mac and cheese, and the other a scaled portfolio of its North America staples such as Oscar Mayer, Kraft singles and Lunchables.

Buffett had expressed his disappointment in the split at the time.

The company also said on Tuesday that it expects to release its fourth-quarter and full-year 2025 financial results on Feb. 11, 2026.

How Did Stocktwits Users React?

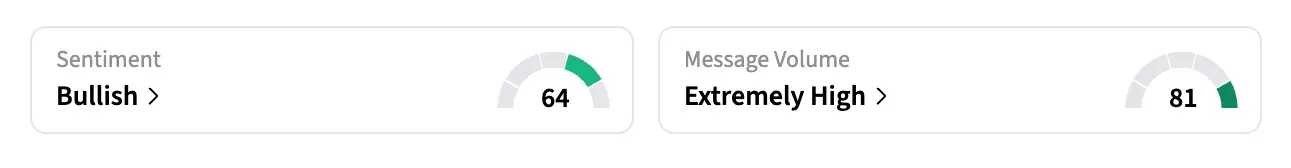

On Stocktwits, retail sentiment around KHC stock jumped from ‘neutral’ to ‘bullish’ territory over the past day amid ‘extremely high’ message volumes.

One bullish user said that even if Berkshire Hathaway were to sell its shares, it would be at a higher price. The user predicted a share price jump to $50.

Shares of KHC have lost over 19% of their value in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)