Advertisement|Remove ads.

Why Did 89bio Stock Nearly Double In Value Today?

Shares of 89bio, Inc. (ETNB) jumped 86% in the pre-market session on Thursday after the company said that it has entered into a merger agreement to be acquired by Roche (RHHBY) for up to $3.5 billion on a fully diluted basis.

The company stated that Roche will acquire it for $14.50 per share in cash at closing, representing a premium of approximately 79% to the stock’s closing price on Wednesday. 89bio shareholders will also receive a non-tradeable contingent value right to receive up to an aggregate of $6 per share in cash receivable upon the achievement of certain milestones.

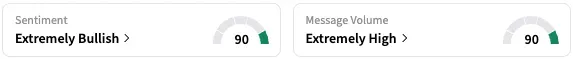

On Stocktwits, retail sentiment around ETNB stock jumped from ‘neutral’ to ‘extremely bullish’ territory over the past 24 hours, while message volume rose from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user urged investors to buy the stock now.

Another opined that the buyout represents a broader trend in which good biopharmaceutical firms are being acquired.

Under the deal, an affiliate of Roche will commence a tender offer to acquire all of 89bio’s outstanding shares.

The closing of the transaction is expected to occur in the fourth quarter, subject to the fulfillment of all closing conditions. Until then, 89bio will operate as a separate and independent company. After the closing of the deal, 89bio will join the Roche group as part of its pharmaceuticals division.

The deal includes 89bio’s Pegozafermin, currently in late-stage trials for the treatment of metabolic dysfunction-associated steatohepatitis (MASH) with advanced fibrosis. MASH is a progressive disease characterized by the accumulation of fat in the liver, leading to inflammation and tissue damage.

ETNB stock is up 3% this year but down approximately 3% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)