Advertisement|Remove ads.

Why Did Barrick Gold Stock Climb 3% In Premarket On Tuesday?

- Elliott Management has become one of the top 10 shareholders in Barrick, implying an investment of at least $700 million, according to FT.

- Barrick is reportedly weighing options to separate North American assets from its business in high-risk jurisdictions across Africa and Asia.

- The move could also involve selling its African operations and Pakistan’s Reko Diq project.

Shares of Barrick Gold Corp. (ABX) were up 3% in Tuesday’s pre-open trade on reports that activist hedge fund Elliott Management had acquired a significant stake in the company.

Elliott Management has become one of the top 10 shareholders in Barrick, implying an investment of at least $700 million, according to a Financial Times report published on Tuesday. The size of Elliott’s stake and its specific demands were not mentioned.

Streamlining Operations

Elliott was encouraged by discussions with Barrick’s board, chaired by John Thornton, to consider splitting the company into two entities, separating its fast-growing North American assets from its business in high-risk jurisdictions across Africa and Asia, according to a Reuters report last week.

The move could also involve selling its African operations and Pakistan’s Reko Diq project once financing is secured. A split would effectively unwind Barrick’s 2019 merger with Randgold and shift emphasis back to core North American assets, including the Fourmile project in Nevada.

The company has faced rising geopolitical risks, highlighted by the loss of control of its Loulo-Gounkoto mine in Mali earlier this year, which resulted in a $1 billion write-off.

Lagging Peers

While gold’s record-breaking run this year has led to a 131% gain for Barrick, it still lags behind peers, including Kinross Gold Corp. (KGC), which has gained over 152%. Its 52% gains on a five-year timeframe are significantly below Kinross’ 232% surge and Agnico Eagle’s 144% climb.

In September, Barrick’s long-time Chief Executive Officer, Mark Bristow, departed the company following sustained criticism over production shortfalls and rising costs. Mark Hill took over as the interim CEO.

Year-to-date, spot gold prices (XAUUSD) have climbed 54%.

How Did Stocktwits Users React?

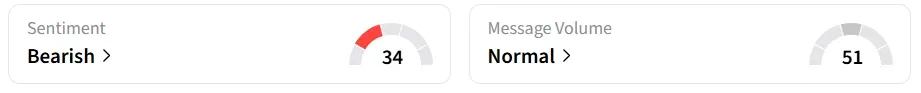

Despite the premarket gains, retail sentiment on Stocktwits has remained in the ‘bearish’ territory over the past 24 hours. It was also among the top trending tickers on the platform at the time of writing.

Also See: Microsoft’s Azure, Amazon’s AWS Come Under EU’s Digital Markets Act Scanner For Potential Curbs

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)