Advertisement|Remove ads.

BofA Securities Resolves DoJ Investigation Into ‘Cash’ Market Manipulation By Former Employees

Bank of America Securities agreed to resolve a U.S. Department of Justice (DoJ) investigation involving two former traders at its U.S. Treasury desk for engaging in schemes to manipulate the “cash” market.

Between November 2014 and about April 2020, the two former employees entered more than one thousand suspected spoof orders, which were placed without the intent to execute them at the time they were placed, the Justice Department said. One of the employees also manipulated the futures market for U.S. Treasuries by entering spoof orders, it added.

“As part of the resolution, the Justice Department has declined to prosecute BoAS, and BoAS will disgorge approximately $1.96 million and contribute approximately $3.6 million to a victim compensation fund it will establish and administer,” the Justice Department said.

The federal investigators noted the BofA unit’s “timely and voluntary self-disclosure” of the misconduct and its “full and proactive cooperation in this matter”, including providing all known information, as some of the reasons behind the decision.

In 2023, the Financial Industry Regulatory Authority (FINRA) fined BofA $24 million for the same case. The stock gained 1.4% on Thursday, and was up 0.2% in extended trading.

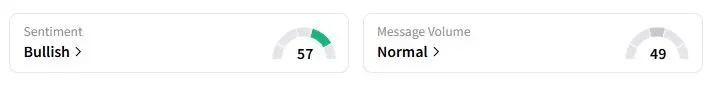

Retail sentiment on Stocktwits about Bank of America was in the ‘bullish’ territory at the time of writing.

Earlier, on Wednesday, the Bank of America CEO Brian Moynihan confirmed in a Bloomberg TV interview that he was not leaving the company in the short term but noted that the management needs to prepare a list of candidates who could run the company in the future.

Bank of America stock has gained 18.1% this year, amid a favorable regulatory environment for the big U.S. banks as well as a rebound in investment banking activity.

Also See: Goldman Sachs Hikes Price Target On Tesla: Analyst’s Q3 Delivery Estimate Now Exceeds Consensus

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)