Advertisement|Remove ads.

Why Is QNCX Stock Up 60% Pre-Market After A Near-Total Wipeout?

- The strategic review could include partnerships, joint ventures, mergers, acquisitions, licensing deals, or other transactions, according to Quince Therapeutics.

- On January 29, QNCX shares plunged 91.5% after the company said it would halt clinical development of its lead asset Edsp.

- Lucid Capital double-downgraded Quince Therapeutics to ‘Sell’ from ‘Buy’ late last month.

Shares of Quince Therapeutics, Inc. (QNCX) surged nearly 60% in pre-market trading on Tuesday after the company announced that it has appointed LifeSci Capital as its exclusive financial advisor to support a restructuring effort and review strategic alternatives.

The strategic review could include partnerships, joint ventures, mergers, acquisitions, licensing deals, or other transactions, according to the company. In addition to assessing these opportunities, LifeSci Capital will advise Quince Therapeutics on any potential restructuring of its liabilities.

Quince, a late-stage biotechnology firm focusing on rare disease treatments, added that it will not provide updates during the review and will disclose developments only if its board approves a specific action or deems further communication necessary.

96% Market Value Erased In Just Over A Week

Quince Therapeutics’ stock has been under heavy selling pressure lately. On January 29, QNCX shares plunged 91.5% after the company said it would halt clinical development of its lead asset, dexamethasone sodium phosphate encapsulated in autologous erythrocytes (eDSP).

The late-stage trial in 105 patients with Ataxia-Telangiectasia, a rare and inherited neurodegenerative disorder, did not meet statistical significance for its primary endpoint. The study also missed its key secondary goal. The stock declined a further 37% in the following session.

QNCX shares have declined nearly 96% from January 28 to Monday’s close.

Wall Street Turns Bearish

The results prompted Lucid Capital to double downgrade Quince Therapeutics to ‘Sell’ from ‘Buy’ with a price target of $0, down from $8. The firm noted that the program, which is Quince’s asset, will be discontinued, and, given that the company’s estimated cash and long-term debt are nearly equal, it sees no value in the shares.

The company has also faced mounting financial pressure. In the third quarter of fiscal 2025, Quince reported a net loss of $13.3 million, more than quadrupling the $3.2 million loss from a year earlier. Total operating expenses jumped 130% to $13.4 million.

How Did Stocktwits Users React?

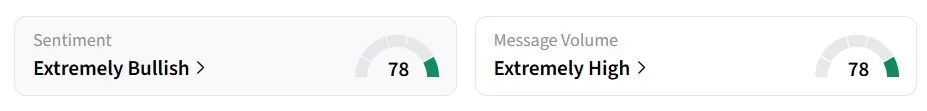

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes.

One bullish user noted the high volumes in after-market trading.

However, one bearish user highlighted the company’s shortcomings in the clinical trial.

Over the past year, the stock has slumped 91%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tilray_logo_resized_c5047aab55.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)