Advertisement|Remove ads.

Why Did Venture Global Stock Rise Over 4% After-Hours?

- The agreement with Mitsui just came a day after Venture Global’s similar agreement with Spain’s Naturgy.

- The company has previously signed supply agreements with other Japanese firms, including JERA and INPEX.

- Venture Global stock fell over 11% on Tuesday after London-based Shell reportedly challenged its defeat in an arbitration case against Venture Global in the New York Supreme Court.

Venture Global (VG) stock rose 4% in extended trading on Tuesday after the firm signed an agreement with Mitsui to supply liquefied natural gas to the Japanese firm.

Under the sales and purchase agreement, Mitsui will buy 1 million tonnes per annum (MTPA) of LNG from Venture Global for 20 years, starting in 2029.

“Venture Global is honored to announce our new partnership with Mitsui, a distinguished leader in the LNG industry, to further increase the flow of U.S. LNG to Japan and the global market,” said Mike Sabel, CEO of Venture Global.

Incessant Demand For US LNG

The agreement with Mitsui just came a day after Venture Global’s similar agreement with Spain’s Naturgy. Last week, the company signed a supply deal with Greece’s Atlantic-See LNG joint venture, marking the first-ever long-term contract between a Greek firm and a U.S. exporter.

The U.S., the world's top LNG exporter, is on course to further bolster its position as the leading source of the commodity, as countries around the globe have pledged to buy more U.S. energy products to reduce their trade surpluses with the U.S.

The agreement with Mitsui was not the first time Venture Global agreed to supply to a Japanese customer. The company secured a supply agreement with JERA in 2023, following a similar deal with INPEX in 2022.

“This agreement builds upon our existing long-term relationships with Japanese companies, and we are deeply grateful for their continued trust in Venture Global. We look forward to delivering LNG safely and reliably for many years to come,” the company said in a statement. In total, the company has secured supply contracts totalling 6.75 MTPA in 2025.

Legal Woes Continue To Mount

Venture Global stock fell over 11% on Tuesday after London-based Shell reportedly challenged its defeat in an arbitration case against Venture Global in the New York Supreme Court, weeks after rival BP won a similar case against the LNG firm.

The dispute stems from Venture Global’s decision in 2022 to sell LNG cargoes from the plant to spot customers, when the commodity's prices soared after Western sanctions on Russia following its invasion of Ukraine. The company’s customers, who have inked long-term contracts, alleged that the company wrongfully profited by selling LNG in the spot market rather than supplying it to them at lower prices.

According to a Reuters News report citing court filings, Shell argued that while the legal hurdle to challenging arbitration decisions is high, it believed such an appeal was justified because Venture Global withheld crucial evidence. Venture Global has maintained that it was allowed to carry out the sales as commercialization of Calcasieu Pass could not be completed due to an issue with a power island.

What Are Stocktwits Users Thinking?

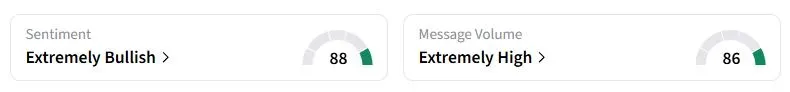

Retail sentiment on Stocktwits about Venture Global moved to ‘extremely bullish’ from ‘bullish’ a day ago, while retail chatter was ‘extremely high.’

“This is going to rip soon. Mark this post,” one user said.

“Big boys know what’s coming, so they push the price down to load up,” another user wrote.

Venture Global stock has fallen nearly 70% since its initial public offering in January.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)