Advertisement|Remove ads.

Why Is Applovin Stock Rising Today?

- Goldman Sachs’ updated price target on the stock implies a 17% potential upside from Wednesday’s closing price of $617.05

- The company’s Q3 revenue and EPS beat street estimates

- Applovin is among the top trending stocks on Stocktwits

Shares of Applovin Corp. (APP) were up nearly 7% in premarket trade on Thursday after Goldman Sachs raised its price target on the stock following the company’s better-than-expected third-quarter results.

Goldman Sachs raised the price target to $720 from $630, while maintaining a ‘Neutral’ rating, implying a 17% upside from Wednesday’s closing price of $617.05. The firm cited strong third-quarter results, supported by robust advertising revenue growth through the company’s AXON 2.0 platform.

AXON is AppLovin’s proprietary AI-powered system that evaluates every advertisement impression in real time.

The firm highlighted management’s confidence in the early rollout of its new self-serve eCommerce advertising portal, which launched late in the third quarter (Q3), noting its potential to extend AXON 2.0’s reach into non-gaming ad demand through 2026 and beyond.

Goldman also emphasized the company’s strong profitability, projecting over 85% incremental adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margins supported by a current gross margin of 78.6% and $3.43 billion in EBITDA.

Upbeat Q3

Applovin’s Q3 revenue came in at $1.41 billion, up 68% year over year and above estimates of $1.34 billion, according to Stocktwits data. Net income nearly doubled to $836 million, while its earnings per share (EPS) of $2.45 exceeded estimates of $2.38.

For the fourth quarter, the company expects revenue between $1.57 billion and $1.6 billion, adjusted EBITDA of $1.29 billion to $1.32 billion, and an adjusted EBITDA margin of 82% to 83%.

How Did Stocktwits Users React?

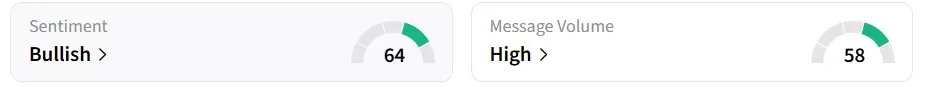

Retail sentiment on Stocktwits flipped to ‘bullish’ from ‘bearish’ territory a session earlier, accompanied by ‘high’ message volumes. At the time of writing, Applovin was among the top trending tickers on Stocktwits.

One user expects the stock to rise to $725 to $730 by Friday.

The stock is currently 20% below its recently hit all-time high of $745. APP shares have seen strong buying interest in 2025 so far, gaining nearly 87%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_bear_crash_93b71a2ed3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_global_e_online_jpg_d113293502.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2210782299_jpg_f1c47d74a6.webp)