Advertisement|Remove ads.

Why Is Barrick Mining Stock Gaining In Premarket?

- NewCo would include Barrick’s stakes in Nevada Gold Mines and Pueblo Viejo, and the Fourmile discovery in Nevada.

- Barrick plans to evaluate the opportunity through early 2026 and will provide an update during its full-year 2025 results in February 2026.

- Last month, Elliott Management reportedly took a major stake and has discussed a potential two-unit breakup with the board, adding weight to Barrick’s latest move.

Shares of Barrick Mining Corp. (B) surged nearly 5% in premarket trading on Monday after the company said it is mulling an initial public offering (IPO) for a new subsidiary that would hold its North American gold assets.

B stock is currently trading at its highest level in more than 13 years.

NewCo IPO

Barrick Mining’s board unanimously authorized the management to explore an IPO of NewCo. The proposed entity would include Barrick’s stakes in Nevada Gold Mines and Pueblo Viejo, along with the company’s wholly owned Fourmile discovery in Nevada.

If the IPO proceeds, only a minority stake in NewCo would be offered to the public, while Barrick would retain a significant controlling interest. The company emphasized that this potential move aligns with its broader strategy to maximize value across its global gold and copper portfolio, with a particular focus on strengthening its North American presence.

Barrick plans to evaluate the opportunity through early 2026 and will provide an update during its full-year 2025 results in February 2026.

Streamlining Operations

Last month, activist hedge fund Elliott Management reportedly acquired a significant stake in Barrick after discussions with the company’s board, led by Chair John Thornton, about potentially splitting the miner into two units, one centered on its rapidly growing North American assets and another on operations in higher-risk regions across Africa and Asia.

The potential restructuring could also include selling the company’s African mines and the Reko Diq project in Pakistan once financing is finalized.

Barrick also settled with the Government of Mali in November to resolve all outstanding disputes related to the Loulo and Gounkoto mines. Under the agreement, Mali will drop all charges and release four detained employees, while Barrick will regain full operational control and withdraw its arbitration cases at the International Centre for Settlement of Investment Disputes.

How Did Stocktwits Users React?

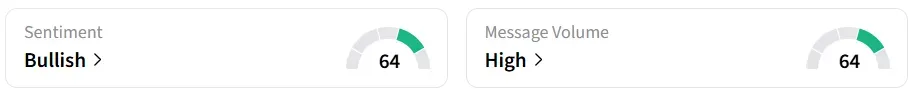

Despite the premarket gains, retail sentiment on Stocktwits moved to ‘bullish’ from ‘extremely bullish’ a day earlier.

Barrick stock has jumped over 160% this year amid the rally in bullion prices, but its gains still lag those of some peers, including Kinross Gold, which has surged 200%, and Hecla Mining’s 236% gains.

Also See: Why Did WBX Stock Gain In Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_transocean_OG_jpg_4d836b625f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)