Advertisement|Remove ads.

Why Is Enphase Stock Falling Over 9% Premarket?

- For the fourth quarter, Enphase projected revenue of $310 million to $350 million, while analysts expect $382.97 million.

- Enphase said it expects a decline in safe-harbor revenue in the fourth quarter. It will also cut shipments to lower inventory levels.

- It also projected a decline in Q1 revenue due to the expiration of tax credits.

Enphase Energy (ENPH) stock fell over 9% in premarket trading on Wednesday after the solar inverter maker projected fourth-quarter revenue below Wall Street’s estimates.

For the fourth quarter, Enphase projected revenue of $310 million to $350 million, while analysts expect $382.97 million, according to Fiscal.ai data. The firm also projected a larger-than-normal seasonal decline in revenue in the first quarter of 2026. Rival SolarEdge’s shares also fell 1%.

However, in the third quarter, Enphase posted revenue of $410.4 million, the highest in two years, helping it top Wall Street’s estimate of $369.6 million. Its net income also rose $66.63 million or $0.50 per share, for the three months ended Sept. 30, compared with $45.76 million, or $0.33 per share, a year earlier.

The company attributed the rise to an uptick in domestic demand and safe-harbor revenue. Solar developers often use the safe harbor tool to obtain the applicable tax credits after demonstrating good-faith efforts to begin projects on time. Essentially, project developers stockpile key equipment, such as panels or inverters, to illustrate the project's viability.

Why Did Enphase Forecast Tepid Sales?

Enphase said it expects a decline in safe-harbor revenue in Q4, as customers asked the inverter maker to expedite shipments before the U.S. Treasury’s new guidance on the same. The company also said it is reducing shipments to help destock inventory.

U.S. renewable project developers have been hit by the Trump administration’s signature tax bill, which has cut down on the subsidies for solar or wind projects that were pledged under the Inflation Reduction Act.

“We anticipate a larger-than-normal seasonal decline [for Q1], following the expiration of [the] '25 tax credit, and estimate a company revenue of $250 million. We view Q1 as the cycle trough with conditions improving through the rest of the year,” said Enphase CEO Badri Kothandaraman.

What Is Retail Thinking?

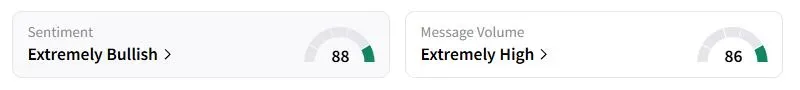

Retail sentiment on Stocktwits about Enphase was still in the 'extremely bullish' territory at the time of writing.

"Solar isn’t going anywhere. Energy independence for homeowners is key," one bullish trader said despite the dour outlook.

"This isn’t going anywhere. Profitable, well run company. Headwinds due to macro issues, which will pass," another trader said.

Why Is Enphase Still Upbeat About The Future?

Enphase said U.S. power prices are rising about 5% this winter, with additional increases expected in 2026, bolstering the case for higher residential demand. It also hopes to benefit from declining interest rates, which are expected to improve the cost economics of solar projects.

“Power price outlooks are surging on the back of AI power demand as well as overall electrification growth. Utilities are struggling to keep up with this demand, creating bottlenecks and price inflation across the grid that are poised to accelerate,” the firm said.

The company said its new IQ electric vehicle (EV) chargers and upcoming IQ bidirectional EV chargers are poised to expand its market, and the fifth-generation battery system paired with IQ 9 residential microinverters would help cut down system costs in both the U.S. and Europe.

Enphase stock has fallen 47.7% this year.

Also See: Bitcoin, Major Cryptos Edge Lower Ahead Of Fed Decision — Bitwise Solana ETF Makes Blockbuster Debut

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)