Advertisement|Remove ads.

Why Is Brazil’s Nu Holdings Stock Rising Premarket?

Nu Holdings stock (NU) edged higher in premarket trading on Wednesday after it received a rare double upgrade from Citi on the potential for an earnings boost.

Citi raised it to ‘Buy’ from ‘Sell’ and doubled the price target to $18 from $9. The new price target implied a 37% upside compared to the stock’s previous closing price. According to Fiscal.ai data, the stock has a consensus price target of $15.53.

According to TheFly, Citi analysts wrote that despite concerns about the macroeconomic environment, the brokerage believes the recent quarters are proof of the bank's ability to not only navigate well but also accelerate in key portfolios while maintaining sound asset quality.

The brokerage also reportedly noted that Nu's earnings momentum could accelerate, not only driven by its core market, Brazil, but also by strong growth from Mexico and Colombia.

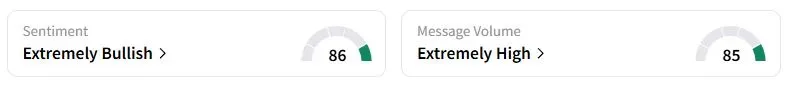

Retail sentiment on Stocktwits was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’

Last week, the fintech firm posted a 33% surge in second-quarter net interest income to an all-time high of $2.1 billion, aided by 4.1 million in net customer additions. In Brazil, Nu is the third-largest financial institution by number of customers, according to the Brazilian Central Bank.

The firm’s monthly average revenue per active customer (ARPAC) crossed the $12 mark for the first time, reaching $12.2 in the second quarter, implying an 18% gain compared to a year earlier on a foreign currency neutral basis.

“This is the next big Fintech and banking company,” one Stocktwits user said.

Nu stock has gained 26.5% this year. Earlier this week, its CEO sold nearly 33 million shares.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)