Advertisement|Remove ads.

Why Is Cadrenal Therapeutics Stock Drawing Retail Attention Today?

- The company outlined progress on its anticoagulation pipeline, including its HIT program VLX-1005, at a Lytham Partners investor summit.

- Cadrenal said VLX-1005 has completed a Phase 2 trial, with data under review and FDA discussions planned.

- Shares fell 4% on Friday before ticking higher after the close.

Cadrenal Therapeutics drew renewed retail investor interest on Tuesday after the biotech company outlined progress across its anticoagulation pipeline, VLX-1005, which it acquired from Veralox Therapeutics in December.

At a fireside chat at the Lytham Partners Healthcare Investor Summit, Cadrenal CEO Quang Pham and acting Chief Scientific Officer Matt Boxer described how the asset fits into the company’s broader strategy to address gaps left by long-standing anticoagulants such as Warfarin and Heparin, as well as newer direct oral anticoagulants (DOACs).

The stock fell 4% to close at $7.87 on Friday, before edging up 0.8% in after-hours trading.

Targeting A High-Risk Complication Of Heparin Use

VLX-1005 is being developed for heparin-induced thrombocytopenia, or HIT, a condition caused by an immune reaction to heparin. Boxer said patients exposed to heparin can develop antibodies that form complexes with platelet factor 4.

This process leads to platelet consumption while simultaneously triggering clot formation, he said. As a result, patients can develop thrombosis and ischemia, with cases sometimes progressing to amputations, organ failure, and death, even though they were initially given heparin for anticoagulation.

Boxer said existing treatments mainly work by inhibiting the clotting cascade, a strategy that can increase bleeding risk in patients with already low platelet counts. He added that about 50,000 confirmed new HIT cases occur each year in the U.S., driven in part by the continued use of heparin in cardiovascular surgery, with cases also seen globally.

Phase 2 Data And Next Steps

VLX-1005 was designed to act earlier in the disease process by blocking 12-lipoxygenase (12-LOX), an enzyme that plays a role in triggering immune-driven platelet activation.

The program has completed a Phase 2 clinical trial, with the database locked and data currently under analysis. Pham said the company has been engaging with primary investigators through introductions made by the Veralox team and expects the data to be published in the near term.

VLX-1005 has received both Orphan Drug and Fast Track designations from the U.S. Food and Drug Administration (FDA). Pham said work on chemistry, manufacturing and controls is underway, with discussions with the FDA expected later this quarter.

Other Programs In Development

Alongside VLX-1005, Cadrenal is advancing Tecarfarin, a vitamin K antagonist designed to be more kidney-friendly, for patients with end-stage kidney disease and atrial fibrillation, as well as those with implanted mechanical heart valves and left ventricular assist devices. Tecarfarin holds orphan drug designations for patients with end-stage kidney disease (ESKD) and atrial fibrillation (AFib), as well as for those with left ventricular assist devices (LVADs).

Pham also referenced Fruinexian, a short-acting Factor XI candidate acquired in late 2025 for use in cardiovascular surgery, noting broader industry interest in Factor XI inhibitors as the company awaits the first approvals in the class.

How Did Stocktwits Users React?

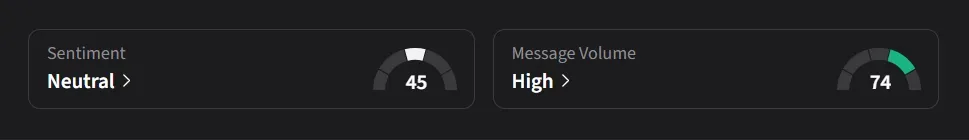

On Stocktwits, retail sentiment for Cadrenal was ‘neutral’ amid ‘high’ message volume.

One user said, “$CVKD is showing early strength.”

Another user described the stock’s current levels as a zone to keep an eye on.

Cadrenal’s stock has declined 57% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)