Advertisement|Remove ads.

Why Is Ingersoll-Rand Stock Falling Premarket Today?

- Despite posting better-than-expected Q3 revenue, the company’s muted earnings forecast disappointed investors.

- Ingersoll Rand reported quarterly revenue of $1.96 billion, which topped analysts’ expectations of $1.90 billion.

- The firm’s industrial technologies and services segment revenue rose 5% year over year to $1.54 billion, but margins decreased.

Ingersoll Rand stock (IR) fell 3.5% in premarket trading on Friday after the company forecasted annual earnings below Wall Street’s estimates.

The company forecast adjusted earnings of $3.25 to $3.31 per share for the year, while analysts expect it to post earnings of $3.36 per share, according to Fiscal.ai data. The company earlier projected full-year earnings between $3.34 and $3.46 per share.

The tepid outlook took some of the shine off its upbeat third-quarter revenue. Ingersoll Rand reported quarterly revenue of $1.96 billion, which topped analysts’ expectations of $1.90 billion. Its adjusted earnings of $0.86 per share came in line with estimates.

Tariff Impact Affects Margins

The firm’s industrial technologies and services segment revenue rose 5% year over year to $1.54 billion. The unit encompasses a broad range of compressors, vacuum blowers, and air treatment solutions, as well as industrial technologies, including power tools and lifting equipment.

U.S. President Donald Trump’s dynamic tariff policy has severely impacted demand in some sectors. The company said its adjusted EBITDA margin was down year over year, primarily due to the flow-through of organic volume declines, the dilutive impact of tariffs, and continued commercial investments for growth.

Its precision and the science technologies segment, which provides mission-critical precision liquid, gas, air, and powder handling technologies for life sciences and industrial applications, showed a 5% uptick in revenue.

"We delivered positive organic orders growth in the third quarter across both segments," said Vicente Reynal, CEO of Ingersoll Rand. "Our performance demonstrates the resilience of our business, which, combined with our strong balance sheet, enables durable long-term growth."

What Is Retail Thinking?

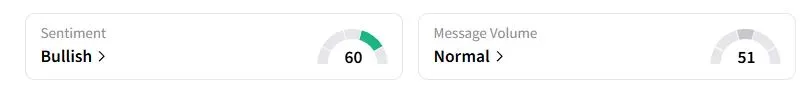

Retail sentiment on Stocktwits about Ingersoll-Rand was in the ‘bullish’ territory at the time of writing.

Ingersoll Rand stock has fallen 13.8% this year, underperforming both the S&P 500 and the Nasdaq 100.

Also See: Why Is Coinbase Stock Gaining Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2169625480_jpg_988055282a.webp)