Advertisement|Remove ads.

Why Is Jeffs’ Brands Stock Rising Today?

- Jeffs' Brands sold about 10% of its stake in Fort Technology.

- The deal values Fort Technology on a fully diluted basis at up to C$20 million.

- The firm had earlier proposed changing its name to Nexera Technologies.

Shares of Jeffs’ Brands (JFBR) jumped nearly 8% in premarket trading on Friday after the company sold about 10% of its stake in Fort Technology to focus on homeland security and advanced technologies.

The company said it has entered into a share transfer agreement with institutional investors to sell and transfer around 1.43 million common shares of Fort Technology for a total value of C$928,571 ($680,261). The shares represent about 10% of Jeffs’ Brands' holdings in Fort and about 7.4% of Fort’s outstanding shares.

The deal valued Fort at C$12.5 million and on a fully diluted basis at up to C$20 million.

Shift In Focus

Jeffs’ Brands has been planning to shift its focus from e-commerce to the homeland security market. Last week, it announced a corporate rebranding, intending to rename itself “Nexera Technologies”, pending necessary approvals.

The firm had earlier signed a non-binding memorandum of understanding (MOU) with Scanary, an Israeli deep-tech developer of 3D imaging, electromagnetic, AI-powered threat detection systems, enabling the firm to enter the homeland security space. Under the deal, Jeffs’ Brands agreed to make a one-time payment of $1,000,000 to Scanary, payable in five equal monthly installments of $200,000.

The global homeland security market is expected to grow from $651.5 billion in 2026 to $923.9 billion in 2031 and $1.11 trillion by 2035, at a compounded annual growth rate (CAGR) of 6.1%, according to a report published by Global Market Insights.

U.S. President Donald Trump has sought to increase spending on homeland security by nearly 65% from 2025 levels to crack down on illegal immigration and to bolster state and local capacity to enhance security around key events like the 2026 FIFA World Cup and the 2028 Olympics.

How Did Stocktwits Users React?

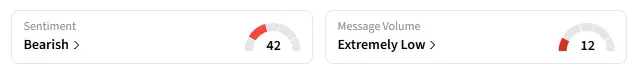

Retail sentiment around JFBR trended in “bearish” territory amid “extremely low” message volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange Rate: C$1 = $0.73)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)