Advertisement|Remove ads.

Why Is Nvidia Stock Rising In Premarket Today?

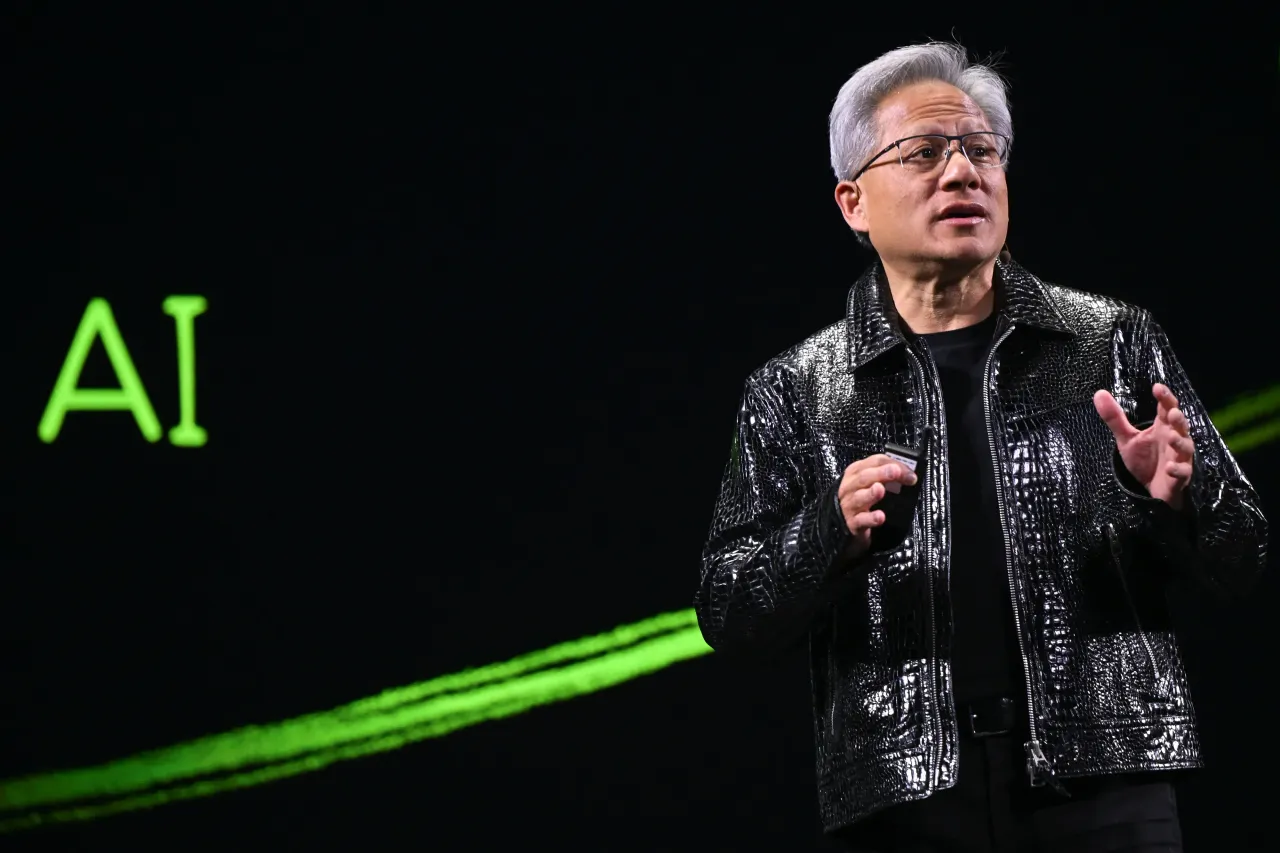

- Bloomberg reports that Nvidia CEO Jensen Huang is set to visit China later this month and could meet with Beijing officials to push for the resumption of H200 sales in the country.

- NVDA suffered its worst decline in three months on Tuesday.

- Stocktwits sentiment for NVDA shifted to ‘neutral’ as of early Wednesday, from ‘bullish’ the previous day.

Nvidia, Inc.’s shares rose nearly 1% in early premarket trading on Wednesday, rebounding after suffering one of their sharpest declines in recent months a day earlier.

The chip giant’s stock lost 4.4% on Tuesday, its worst drop in over three months, amid a broad market sell-off in response to the rising geopolitical risks tied to the U.S.–Greenland situation.

Bloomberg News reported late Tuesday that Nvidia CEO Jensen Huang plans to visit China later this month as he works to resume exports of the company’s AI chips to the country, amid mixed signals from Washington and Beijing.

Nvidia’s sales in China have been under pressure for years amid U.S.-China trade tensions. Under the Biden administration, exports of advanced artificial intelligence chips to China were restricted, limiting the most powerful processors Nvidia could legally ship to the country. Until recently, the H20 was the most advanced Nvidia artificial intelligence chip permitted for export to China under U.S. rules.

That stance shifted in late 2025, when the Trump administration reversed an earlier ban and allowed the sale of Nvidia’s more powerful H200 artificial intelligence chips to select Chinese customers. The approval, however, comes with strict conditions, including enhanced oversight and a revenue-sharing arrangement with the U.S. government.

Previously, Nvidia had to write down $5.5 billion in inventory earmarked for China.

Beijing, too, has reportedly sent mixed signals about the sale of Nvidia chips in the country, as it seeks to strike a balance between locally designed chips and advanced technology from the U.S.

Huang will be in China to attend company parties ahead of the Lunar New Year holidays, according to Bloomberg’s sources. He is also expected to visit Beijing, though it’s unclear whether he will meet with senior Chinese officials.

U.S. stock futures rose early Wednesday as well, with increased attention on the World Economic Forum in Davos today, where Trump is set to arrive to discuss his plans for Greenland.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: PAAS Stock Hits New Highs As Silver Output Rises, Gold Stays On Track And Cash Piles Up

Editor's note: An earlier version of this article misstated the sequence of U.S. export restrictions on Nvidia's AI chips. The Hopper-based H20, along with the lower-end L20 and L2 variants, were the most advanced processors permitted for sale in China under U.S. rules. The article incorrectly suggested that sales of the more powerful H200 preceded this framework.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)