Advertisement|Remove ads.

Why Is NVDA Stock Down 3% In Premarket Today?

- If Nvidia’s drop holds in the regular session, it would be the stock’s worst intraday performance this year.

- Trump has sharply escalated his push for the U.S. to take control of mineral-rich Greenland.

- Nvidia’s stock is also under pressure due to the long-term uncertainty over the sale of its equipment in China.

Nvidia Corp. shares fell about 3% in early premarket trading on Tuesday and trended on Stocktwits, as investors weighed rising geopolitical risks tied to the U.S.–Greenland situation alongside continued delays in sales of its H200 chips in China.

If the move holds in the regular session, it would be the stock’s worst day since Dec. 17.

“$NVDA getting killed yikes,” a user remarked. Another bullish user said, “Sell all you want, I’m coming tomorrow to buy all.”

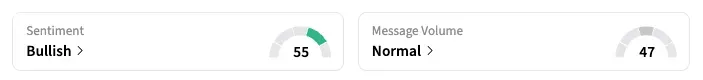

However, on Stocktwits, retail sentiment for NVDA remained in the ‘bullish’ zone, unchanged from the previous day.

Over the weekend and on Martin Luther King Jr. Day, Trump sharply escalated his push for the U.S. to take control of mineral-rich Greenland. The situation is rapidly becoming a major risk as talks between the U.S. and representatives from Denmark, Greenland, and other European powers falter, while troop deployments continue to build up on the Arctic island.

Meanwhile, Nvidia continues to face uncertainty over the resumption of sales of its H200 chips in China amid mixed signals from Washington and Beijing. Taiwan's Inventec President Jack Tsai said the decision on the issue "appears to be stuck on the China side, Reuters reported.

Over the past week, Nvidia and a broad swath of semiconductor stocks gained after Taiwan Semiconductor Manufacturing Co., the world’s largest contract chipmaker, posted blowout results.

NVDA is down marginally so far this month; the stock gained 39% over 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Netflix Q4 Earnings: Three Things Investors Are Watching

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)