Advertisement|Remove ads.

Why Is State Street Stock Gaining In Premarket Trading?

State Street (STT) stock rose nearly 1% in premarket trading with thin volumes on Friday, after Citi raised the stock to ‘Buy’ from ‘Neutral.’

According to TheFly, the brokerage also raised the price target of the stock to $130 from $115. The new price target implies a near 14% upside compared to its closing price on Thursday.

The brokerage noted that while the return profiles of trust banks are impacted by volatility in the global market, the firm sees an "attractive opportunity" in State Street to drive organic fee growth while maintaining expense discipline to deliver positive operating leverage.

Momentum in new servicing wins also serves as evidence of "growing traction," Citi analysts reportedly said.

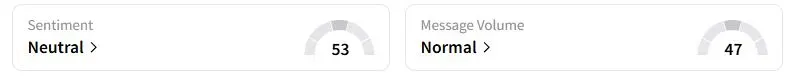

Retail sentiment on Stocktwits about State Street was in the ‘neutral’ territory at the time of writing.

The custodian bank's assets under custody and administration increased 10.6% to $49 trillion in the three months ended June 30, compared to the same period a year earlier, driven by higher market levels and flows. Its total fee revenue, the bulk of which it earns as a percentage of assets, climbed 10.7% to $2.72 billion in the quarter.

However, its quarterly profit slipped about 3% compared to the previous quarter.

State Street stock has gained over 16% this year.

Also See: Oil Prices On Track For Weekly Loss As Oversupply Concerns Mount

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)