Advertisement|Remove ads.

Why Is Trump Suing JPMorgan Chase And Its CEO For $5 Billion?

- The lawsuit, which was filed in Miami-Dade County, Florida, sought a minimum of $5 billion in damages.

- The suit claimed “considerable financial harm and losses” due to disrupted financial services, “devastating impact” on financial transaction ability, less favorable terms with other banks, and extensive reputational harm.

- The complaint also said that the bank, under Dimon’s direction, had placed President Trump, his family, and some associated entities on a blacklist that was accessible by federal banks.

U.S. President Donald Trump is suing leading bank JPMorgan Chase & Co. (JPM) and its chief executive officer Jamie Dimon for closing his and his related parties’ bank accounts in 2021.

The lawsuit, which was filed in Miami-Dade County, Florida, sought a minimum of $5 billion in damages, claiming “considerable financial harm and losses” due to disrupted financial services, “devastating impact” on financial transaction ability, less favorable terms with other banks, and extensive reputational harm.

As per the lawsuit, the account closures came after the Jan. 6, 2021 riot in the U.S. Capitol. Former President Joe Biden took over shortly after.

“In essence, JPMC debanked Plaintiffs’ Accounts because it believed that the political tide at the moment favored doing so,” the lawsuit alleged.

What Else Does The Lawsuit Say?

Filed by Trump's attorney Alejandro Brito, the lawsuit claimed that the bank’s “reckless decision” is leading a growing trend in the U.S. for financial institutions to cut off access to consumers whose political views do not align with that of the bank. This is an attempt to coerce the public to change its political views, as per the lawsuit.

“Plaintiffs are confident that JPMC’s unilateral decision came about as a result of political and social motivations, and JPMC’s unsubstantiated, ‘woke’ beliefs that it needed to distance itself from President Trump and his conservative political views,” the lawsuit said.

In addition, the complaint said that the bank, under the direction of Dimon, had placed President Trump, his family, and some associated entities on a blacklist that was accessible by federal banks, calling it an “intentional and malicious falsehood,” while also adding that the accused have always abided by the law.

The suit added allegations of trade libel, breach of implied covenant of good faith and fair dealing by the bank, and violations of Florida’s Unfair and Deceptive Trade Practices Act by Dimon.

JP Morgan’s Response

In response to the lawsuit, JP Morgan issued an official statement, saying that the suit has no merit. “We respect the President’s right to sue us and our right to defend ourselves - that’s what courts are for,” the bank said.

The bank denied closing Trump’s and associated accounts for political or religious reasons. “We do close accounts because they create legal or regulatory risk for the company. We regret having to do so, but often rules and regulatory expectations lead us to do so,” the bank added.

“We have been asking both this Administration and prior administrations to change the rules and regulations that put us in this position, and we support this Administration’s efforts to prevent the weaponization of the banking sector,” JP Morgan further said.

How Did Stocktwits Users React?

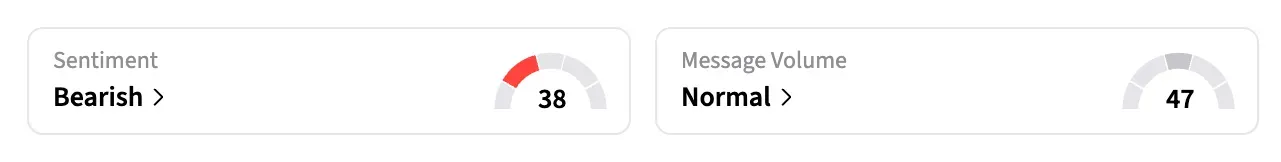

On Stocktwits, retail sentiment around JPM stock trended in the ‘bearish’ territory over the past 24 hours amid ‘normal’ message volumes.

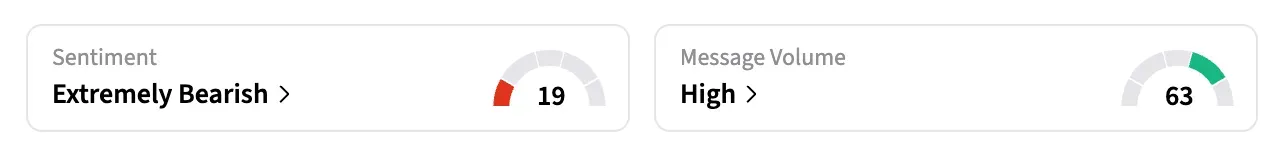

Meanwhile, retail sentiment around the President’s Trump Media & Technology Group Corp. (DJT) was in ‘extremely bearish’ territory amid ‘high’ message volumes.

Shares of JPM gained over 16% in the past year while shares of DJT lost over 56% in the same time.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2167490837_jpg_471b0d5535.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)