Advertisement|Remove ads.

Why Is VisionWave Stock Rising Today? Retail Sentiment Soars As New Funding Deal Fuels AI Defense Push

Defense technology firm VisionWave Holdings Inc. (VWAV) announced on Monday that it has secured strategic funding through a new investment deal with a major institutional backer.

The company announced that it has entered into a Standby Equity Purchase Agreement (SEPA), which gives it the option to raise up to $50 million over the next two years by issuing common stock at its discretion.

Following the news, VisionWave stock jumped over 310% on Monday afternoon.

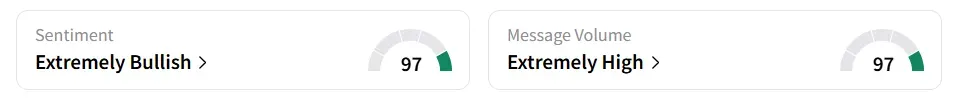

On Stocktwits, retail sentiment towards the stock improved to ‘extremely bullish’ (97/100) from ‘bearish’ territory the previous day. Message volume also shifted to ‘extremely high’ (97/100) from ‘low’ levels in 24 hours.

A bullish trader said the stock is still trading under its ‘usual highs’.

The deal also includes an immediate $5 million funding commitment via convertible notes, with $3 million disbursed upon signing.

The newly secured capital will fuel VisionWave’s ongoing initiatives, including broader deployment of its AI-enhanced defense technologies.

The firm has highlighted use cases across autonomous platforms in air, ground, and sea environments, which are seen as vital for modern military operations.

According to the company, the $5 million convertible note agreement features stipulations to ensure funds aren't used to pay off past liabilities, particularly those incurred before its recent business merger.

On July 15, the company went public via a merger with Bannix Acquisition Corp, a special-purpose acquisition vehicle.

That clause, the company says, guarantees that the funds will directly support innovation, product rollout, and operational scaling.

The equity line gives the firm control over when and how much stock it offers, minimizing dilution and maximizing funding efficiency over the 24-month term.

The investment comes at a critical juncture as defense companies race to deliver next-generation solutions amid shifting geopolitical and technological dynamics.

Also See: MicroVision Stock Slides Despite Positive News On MOVIA Sensor Suite: Retail Goes Contrarian

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)