Advertisement|Remove ads.

Why Kajaria Ceramics Shares Are Rallying: SEBI Analyst Mayank Singh Chandel Explains

Kajaria Ceramics shares surged 4% on Friday after forming a cup-and-handle pattern on its technical charts. The stock has rallied 11% in the last week.

SEBI-registered analyst Mayank Singh Chandel flagged that the stock had been falling since September 2024, but it now showed potential for upside after breaking the ₹1,265 resistance level.

From a technical perspective, Kajaria stock is trading above its 200-day Exponential Moving Average (EMA), which signals a long-term bullish trend. The Relative Strength Index (RSI) is around 72, indicating strong momentum.

Q1 Earnings Reflect Strong Fundamentals

Chandel highlighted that India’s largest maker of tiles posted 21% growth in profits and a subdued revenue growth. This shows that Kajaria is managing costs well, improving profit margins, and holding its top position in the tiles market.

He also added that the company has improved efficiency and margins, likely due to better product mix, lower costs, and cheaper raw materials.

What’s Working For Kajaria?

The brand is well-positioned with premium pricing power, he noted. Additionally, the company’s focus on increasing automation and better production processes has augured well for them.

On the business front, Kajaria is growing in scale in the Middle East, the U.S., and Africa and expanding its retail network with dealer as well as product additions.

Kajaria Ceramics: Growth Triggers

Chandel noted that Kajaria is investing in new plants in Gujarat and Andhra Pradesh, focusing on advanced digital printing technology, and expanding its sanitaryware segment as well as retail stores and online channels.

The Indian tiles industry is expected to grow at 6.8% annually over the next five years, supported by urban growth, real estate recovery, and infrastructure projects.

What Is The Retail Mood?

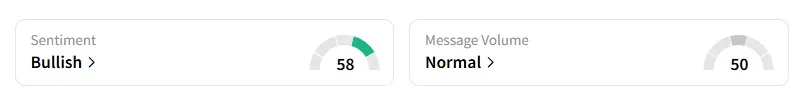

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter.

Kajaria Ceramics shares have risen 13% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)