Advertisement|Remove ads.

Uber Stock Stumbles As Soft Guidance Eclipses Q4 Beat, But Retail Confidence Soars To Year-High

Shares of ride-hailing firm Uber Technologies Inc (UBER) fell over 3% in Wednesday’s pre-market session despite the company reporting upbeat fourth-quarter earnings as guidance for the first quarter came in softer than expected.

Uber reported a 20% year-over-year (YoY) rise in its fourth-quarter revenue to $11.96 billion compared to a Wall Street estimate of $11.78 billion.

The company’s Q4 net income rose 382% YoY to $6.88 billion. However, the figure includes a $6.4 billion benefit from a tax valuation release and a $556 million benefit (pre-tax) due to net unrealized gains related to the revaluation of Uber’s equity investments. Earnings per share (EPS) came in at $3.21 versus an estimated $0.48.

CEO Dara Khosrowshahi said Q4 was the firm’s strongest quarter ever, supported by accelerating growth across segments.

The company’s gross bookings grew 18% YoY to $44.2 billion compared to an analyst estimate of $43.49 billion. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) rose 44% YoY to $1.8 billion, while adjusted EBITDA margin as a percentage of gross bookings rose to 4.2% from 3.4% in Q42023.

For the first quarter of 2025, Uber expects gross bookings of $42.0 billion to $43.5 billion, with the firm’s outlook assuming a roughly 5.5 percentage point currency headwind. This compares with an estimate of $43.51 billion.

CFO Prashanth Mahendra-Rajah highlighted that record demand in both Mobility and Delivery helped the firm grow gross bookings faster than the high end of its guidance. “…we closed out 2024 exceeding our three-year outlook for gross bookings, adjusted EBITDA, and free cash flow,” he said. “We believe we remain undervalued despite these strong fundamentals and plan to be active and opportunistic buyers of our stock.”

Uber reportedly said it is opening its “interest list” to users in Austin, Texas, who intend to be first in line for Waymo robotaxis. The company noted that users will “be able to travel across 37 square miles of Austin — from Hyde Park, to Downtown, to Montopolis.”

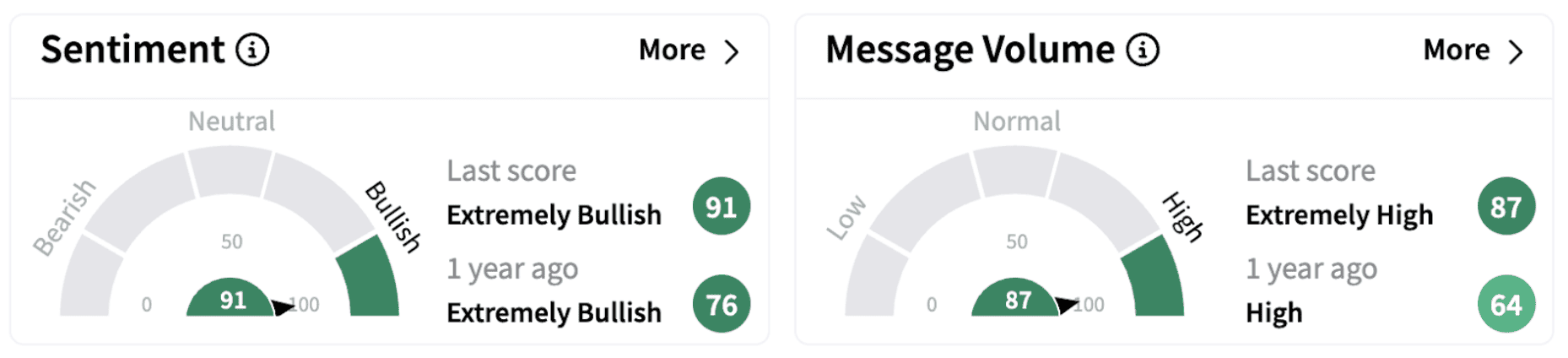

On Stocktwits, retail sentiment climbed into the ‘extremely bullish’ territory (91/100), hitting a one-year high. The move was accompanied by ‘extremely high’ retail chatter.

Meanwhile, Stocktwits user comments indicate a mixed view of the stock. One user sounded pessimistic about the robotaxi plan.

Another user expects the stock to rebound following the initial decline.

Uber shares have gained over 10% since the beginning of 2025 but are up just over a percent in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)