Advertisement|Remove ads.

Why Titan Shares Are Falling: SEBI RA Warns Of Bearish Trend Despite 20% Growth

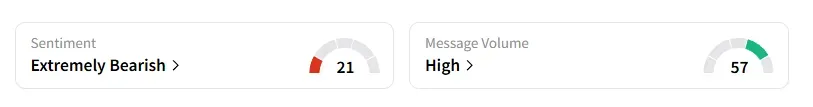

Titan shares slipped more than 5% on Tuesday, despite reporting a 20% growth in its first-quarter operational update. Data on Stocktwits also showed that retail sentiment flipped to ‘extremely bearish’ on this counter amid ‘high’ message volumes.

SEBI-registered analyst Varunkumar Patel decodes the triggers behind this fall:

Titan reported 10% growth in its domestic consumer business for the April–June 2025 quarter (Q1 FY26). The jewellery division grew by 18% year-on-year (YoY), led by Tanishq, Mia, Zoya, and CaratLane.

The watches segment saw 23% growth, while the eyecare business was up 12% year-over-year (YoY). Emerging segments (fragrances, Taneira) increased by 36–56%.

Overall, the domestic store count stood at 3,291. International business delivered a robust 49% growth YoY, with one store addition, bringing the total international presence to 31 stores.

Technical Trends

On the technical charts, on a daily timeframe, the stock is trading below its 20-day Exponential Moving Average (EMA) of ₹3,595 and 50-day EMA at ₹3,520, indicating a bearish sentiment. It, however, held above its 200-day EMA at ₹3,435 (at the time of writing this copy).

Patel pegged immediate support at ₹3,400, with resistance at ₹3,650. Its Relative Strength Index (RSI) is also below 50, suggesting further bearishness.

Brokerages have been cautious on Titan, too. Morgan Stanley flagged a sharp miss versus their estimates (17% growth vs expected 28%) and lowered their target price. JPMorgan maintained a “Neutral” stance, noting the jewellery segment underperformed peers.

What Next?

Going ahead, Patel advised short-term investors to avoid Titan currently. For long-term investors, he suggested entries below ₹3,400 for investment purposes. For traders, as the stock is trading below its key EMAs and the RSI is also indicating bearish sentiment, he advised shorting the stock at the current price, with targets of ₹3,400 and ₹3,250, and a stop loss at ₹3,525 over a 15-day timeframe.

Titan shares have gained 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)