Advertisement|Remove ads.

Will The Fed Cut Rates This Week?

- The FOMC is scheduled to meet on January 27 and January 28.

- Data from CME Group’s Fedwatch tool indicates a 97.2% probability that the Fed will maintain interest rates at the current 3.5% to 3.75% range.

- Goldman Sachs’ Chief U.S. Economist David Mericle is penciling two rate cuts this year.

The Federal Reserve is all set to make its next interest rate decision on Wednesday, amid a backdrop of strong economic growth, low unemployment, and inflation staying above the central bank’s long-term target.

This is also the Federal Open Market Committee’s (FOMC) first meeting in 2026, and comes after three consecutive 25-bps rate cuts. The FOMC is scheduled to meet on January 27 and January 28, with the outcome announced at the conclusion of the two-day meeting.

Data from CME Group’s Fedwatch tool indicates a 97.2% probability that the Fed will maintain interest rates at the current 3.5% to 3.75% range.

The FOMC’s first meeting of 2026 comes at a time when the U.S. economic growth has surpassed expectations. In December, the Bureau of Economic Analysis reported that the U.S. economy grew at an annualized rate of 4.3% in the third quarter (Q3), higher than the Dow Jones forecast of 3.2%, as cited by MarketWatch.

The BEA stated that the acceleration in real GDP in Q3 compared to the second quarter (Q2) reflected a smaller decrease in investment, an acceleration in consumer spending, and an upturn in exports and government spending.

The December jobs report from the Bureau of Labor Statistics (BLS) showed the unemployment rate inching lower to 4.4%, down from a revised 4.5% in November.

The Fed’s preferred inflation gauge, Personal Consumption Expenditures (PCE) index, came in at 2.8% in November on an annualized basis, in line with expectations.

What Do Experts Think?

Experts believe the Fed will keep interest rates steady this week, with Goldman Sachs Chief U.S. Economist David Mericle penciling two rate cuts this year.

However, analysts at ING Think noted that there could be dissent at this week's FOMC meeting from Fed Governors Stephen Miran and Chris Waller.

“Fed Chair Jerome Powell’s robust defense of the central bank’s independence on 11 January, in response to ongoing pressure from the President to lower rates, confirms it,” the firm stated in a recent note.

ING Think analysts also expect two rate cuts this year, while noting that current monetary policy remains “slightly restrictive.”

Collin Martin, head of fixed income research and strategy at the Schwab Center for Financial Research, pointed to the U.S. economy’s resilience, sticky inflation, and a lower unemployment rate as reasons for his expectation that rates will remain unchanged.

“Since the Fed last met, the unemployment rate has improved and economic data suggests the economic momentum has continued. We expect the Fed to hold rates steady for the next few meetings,” Martin said.

Prediction Markets’ Take

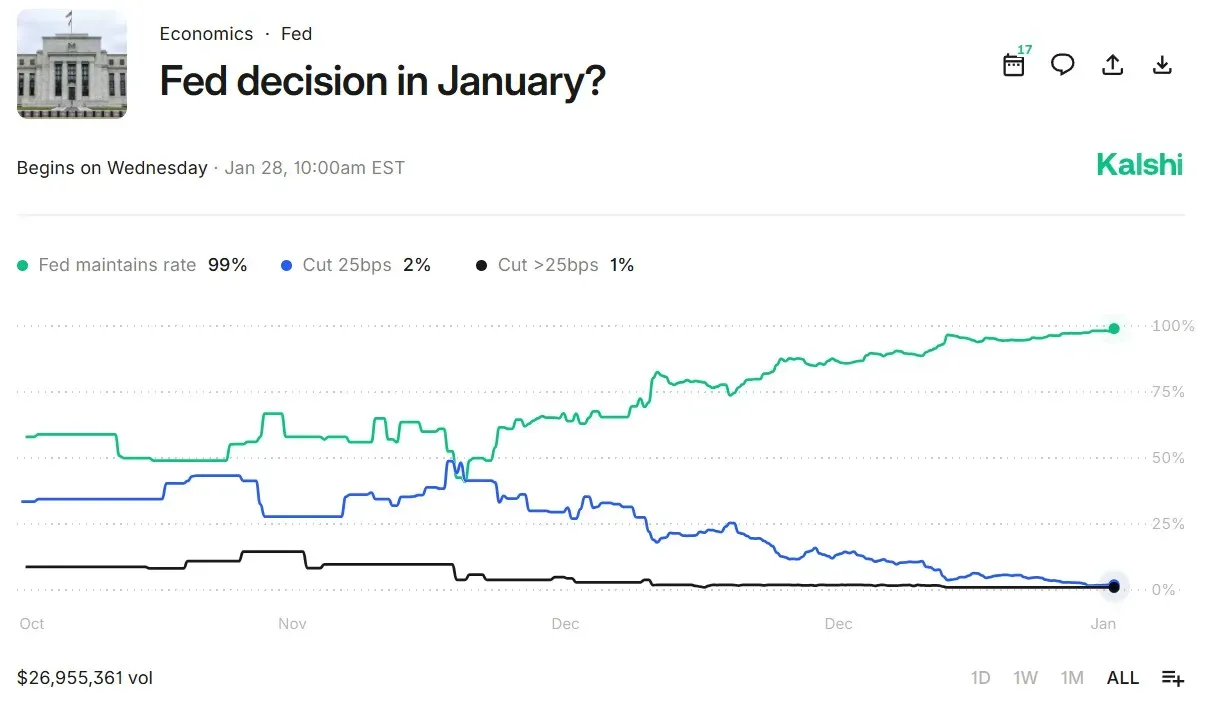

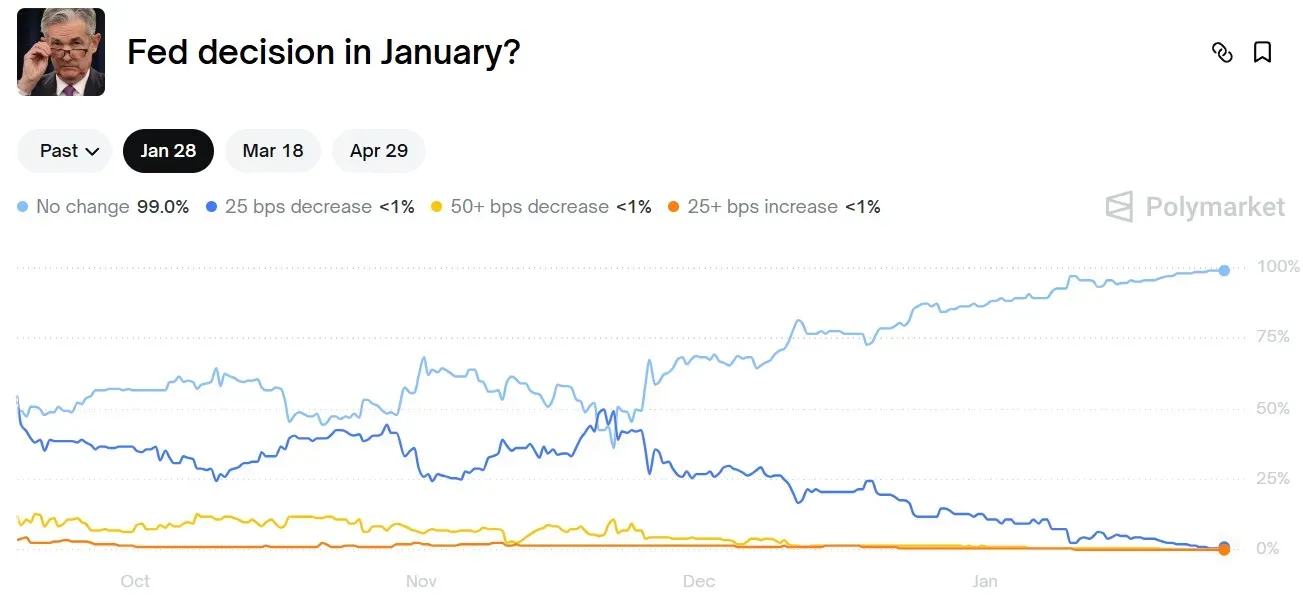

Bettors on popular prediction markets, Kalshi and Polymarket, overwhelmingly expect the Fed to keep rates unchanged this week.

While total betting volumes on the two platforms stood at over $534 million at the time of writing, 99% of the votes were in favor of the Fed keeping rates unchanged.

Meanwhile, U.S. equities gained in Monday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.44%, the Invesco QQQ Trust ETF (QQQ) rose 0.4%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) gained 0.36%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘extremely bearish’ territory.

The iShares 20+ Year Treasury Bond ETF (TLT) was up 0.59% at the time of writing, while the iShares 7-10 Year Treasury Bond ETF (IEF) rose 0.17%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)