Advertisement|Remove ads.

Will The Fed Cut Rates Today? Here's What Bettors On Kalshi And Polymarket Think

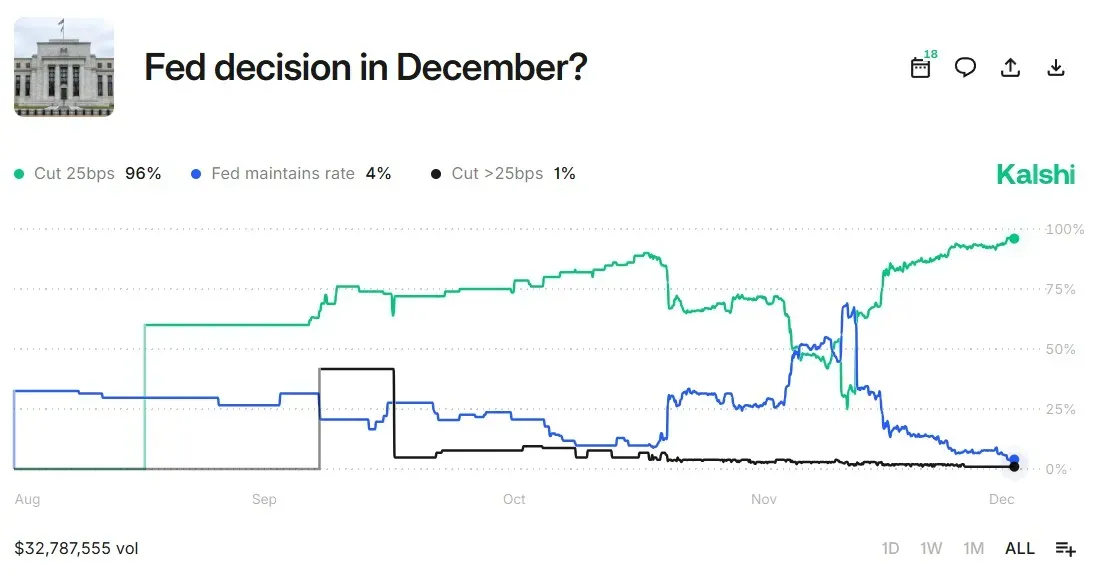

- Data from Kalshi shows a 96% probability that the Fed will cut rates by 25 basis points, while nearly 4% expect the central bank to maintain the current levels.

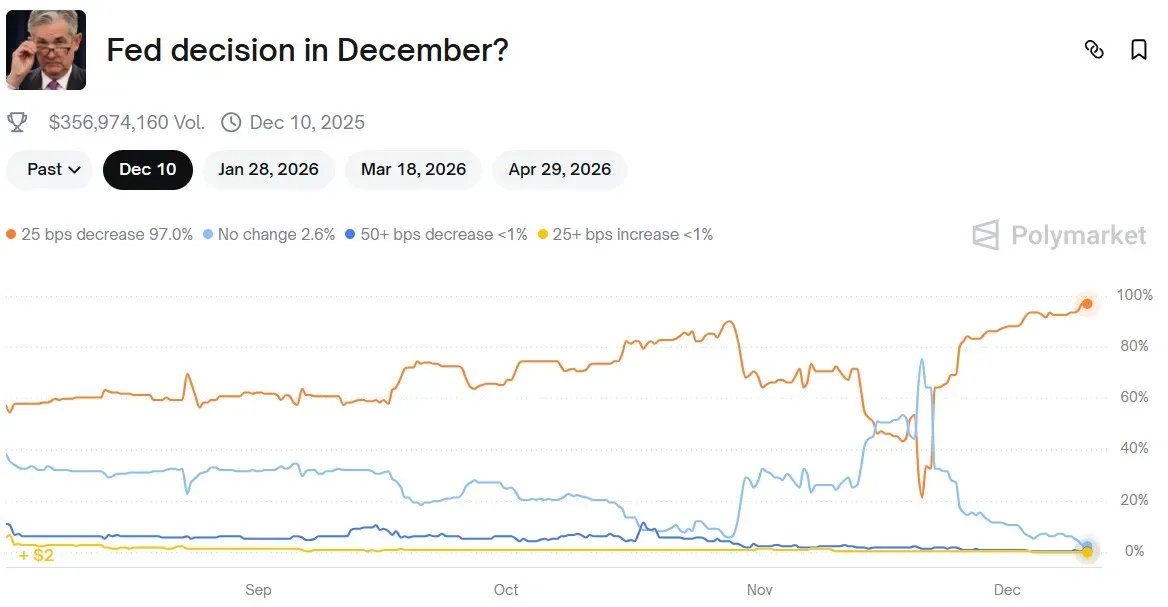

- Participants on Polymarket were slightly more optimistic, with data showing that 97% of bets favored a 25 bps cut.

- Schwab Center for Financial Research stated in a recent note that aside from the rate decision, the focus will be on how many policymakers voice dissenting opinions.

The Federal Reserve is all set to announce its interest rate decision on Wednesday, and bettors on prediction markets are placing hundreds of millions of dollars' worth of bets to guess what the central bank will do.

Bettors on Kalshi and Polymarket have placed bets worth nearly $393 million to predict the outcome of the Federal Open Market Committee’s (FOMC) December meeting, which is set to conclude on Wednesday.

What Are Prediction Markets Showing?

Data from Kalshi shows a 96% probability that the Fed will cut rates by 25 basis points, while nearly 4% expect the central bank to maintain a status quo. Participants on Polymarket were slightly more optimistic, with data showing that 97% of bets favored a 25 bps cut.

According to data from the CME FedWatch tool, there is an 87.6% probability of a 25 bps rate cut on Wednesday.

Room For Further Cuts

If the Fed cuts rates by 25 bps on Wednesday, that leaves little room for further cuts, analysts at Schwab Center for Financial Research pointed out in a note on Wednesday.

“The September projection, which isn't expected to change today, is just 25 basis points below where rates would be if the Fed cuts this afternoon, leaving investors little in the way of ‘energy dots’ from the Fed to whet equity market appetites,” the firm stated.

It added that aside from the rate decision, the focus will be on how many policymakers voice dissenting opinions, and what Fed Chair Jerome Powell says about the rate path going forward.

Meanwhile, U.S. equities were mixed in Wednesday morning’s trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up by 0.09%, the Invesco QQQ Trust ETF (QQQ) declined 0.22%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose 0.5%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘neutral’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up by 0.14% at the time of writing.

Also See: Paul Krugman Questions Trump’s ‘A+++++’ Economy Claim: ‘Why Don’t People See It?’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246877055_jpg_1283ae3088.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)