Advertisement|Remove ads.

WINT Soars, DXCM Plunges, AVXL Gains: Retail Investors' Focus Before the Bell

U.S. stocks rose on Friday morning as investors digested the latest inflation data, which reinforced expectations of a September interest rate cut. The broader market exhibited a mixed performance in the previous session, with early optimism stemming from strong GDP data fading as tech giants dragged down the Nasdaq and S&P 500.

Here’s a look at the top three stocks that captured retail investors’ attention ahead of the opening bell today:

Windtree Therapeutics Inc (WINT)

Shares of Windtree Therapeutics surged by an impressive 150% in pre-market trading to reach a high $9.40. The biopharma company announced an update on its novel heart failure treatment, istaroxime, igniting a buying frenzy among retail investors.

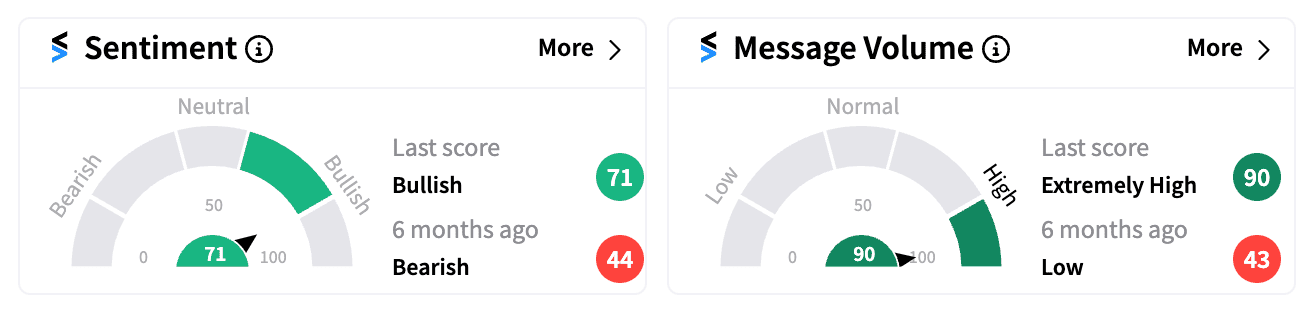

Stocktwits data revealed overwhelmingly bullish sentiment (71/100), with message volume reaching its highest level this year (90/100). While the stock has experienced a significant decline of over 73% year-to-date, today's surge has injected a dose of optimism among investors.

Dexcom Inc (DXCM)

In stark contrast to Windtree's performance, Dexcom Inc witnessed a dramatic decline of over 36% in pre-market trading, settling in the mid $60s. The medical device company's disappointing second-quarter revenue results and a weak FY24 revenue guidance for its glucose monitoring devices triggered a sell-off. Despite the price drop, several analysts maintained price targets well above current levels, suggesting potential upside in the long term.

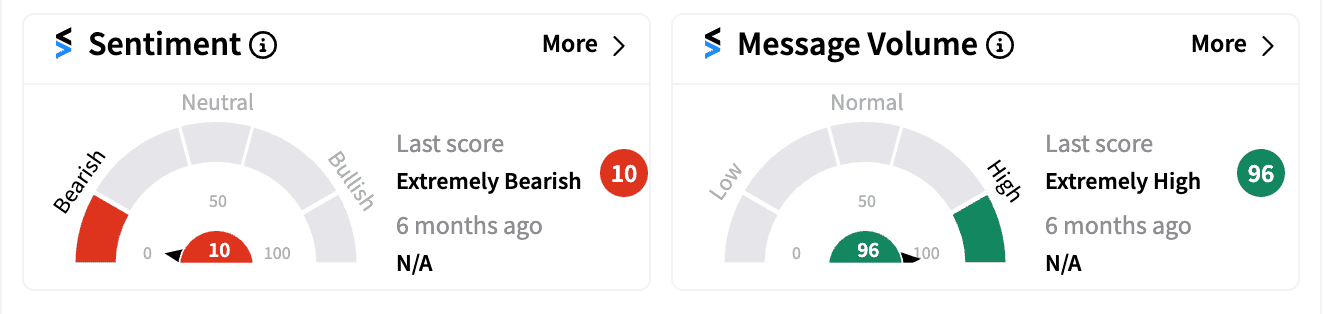

However, retail investor sentiment on Stocktwits plummeted to its lowest point this year (10/100), reflecting the bearish outlook, while message volumes reached a 2024 peak (96/100). Concerns about management’s inability to adequately communicate business issues and its plan to fix it, as well as market share impacts from the adoption of GLP-1 weight loss drugs is keeping retail away.

Anavex Life Sciences Corporation (AVXL)

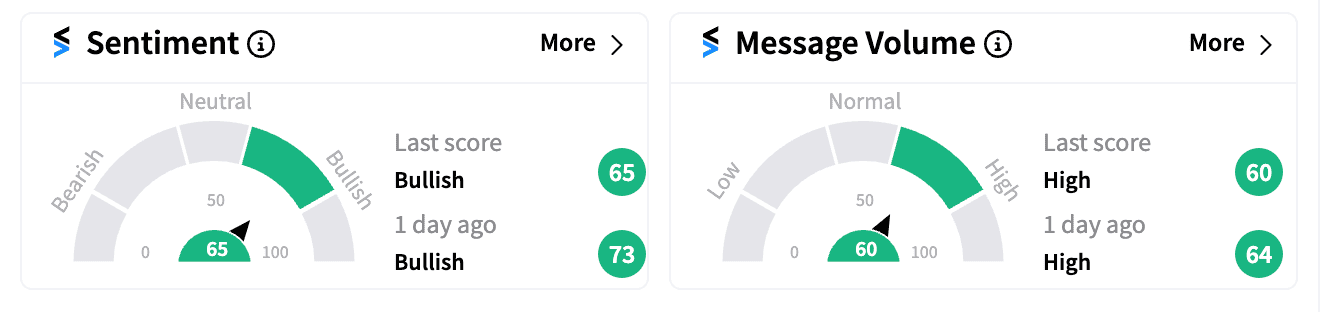

Shares of Anavex Life Sciences Corporation climbed over 4% in pre-market trading to a high of $7.22, with retail sentiment on Stocktwits at bullish levels (65/100).

The neuro-disease-focused biopharma company received a boost from EF Hutton analyst Jason Kolbert, who initiated coverage with a Buy rating and a price target of $46. The analyst highlighted the company's lead therapy, ANAVEX2-73, for Alzheimer's Disease (AD), which is on track for regulatory submission by the end of the year. The potential market for ANAVEX2-73, coupled with its broader therapeutic applications, has fueled investor optimism.

Photo courtesy of syedqaseem on Vecteezy

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)