Advertisement|Remove ads.

Wolfe Research Downgrades Robinhood Stock As Bull Case Has 'Largely Played Out' — Retail Loses No Cheer

Robinhood (HOOD) stock gained retail attention on Tuesday after Wolfe Research downgraded the stock to ‘Peer Perform’ from ‘Outperform’ and removed the previous price target of $51.

According to The Fly, Wolfe analyst Steven Chubak wrote that since the last stock upgrade in June, crucial positive drivers underpinning the firm's bull case have "largely played out" and are now reflected in the current valuation and share price.

The earnings per share (EPS) "bull case" has turned into the base case, the firm noted, with the EPS consensus being revised upward by over 160% since June 2024 and more than 600% over the past year.

Robinhood shares are trading near record highs, aided by strong fourth-quarter earnings and robust growth in funded customers.

The company said earlier in February that its assets under custody nearly doubled to $204 billion at the end of January compared to last year.

The company’s equity notional trading volumes more than doubled to $144.7 billion in January, and total funded customers rose to 25.5 million, a 2 million increase compared to last year.

Its fourth-quarter revenue had more than doubled to $1.01 billion and topped Wall Street estimates, aided by a 487% quarter-over-quarter jump in crypto revenue.

The financial services firm had received a slew of price target hikes following the earnings, with brokerages praising its earnings report.

According to The Fly, Piper Sandler analysts wrote that Robinhood is positioned well to win across many areas of its business in the coming years and the firm is becoming increasingly confident in management's ability to execute.

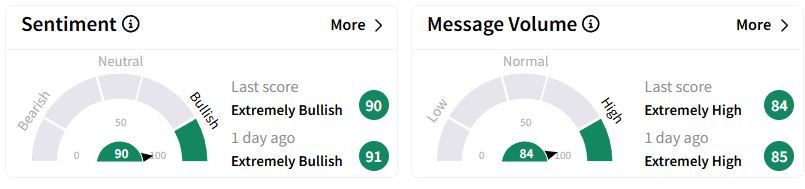

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (90/100) territory, while retail chatter was ‘extremely high.’

Over the past year, Robinhood stock has more than quadrupled.

Also See: Venture Global Sets April Date For Calcasieu Pass LNG Debut: Retail Tunes In But Stays Unfazed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225992712_jpg_0f4e65a72c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_chipotle_resized_jpg_618ebf0d1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208530303_jpg_bfa7565aeb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2214351115_jpg_9770916730.webp)