Advertisement|Remove ads.

Robinhood Stock Accelerates Toward Record Highs After Q4 Earnings Shatter Estimates: Retail Sentiment Flies High

Shares of Robinhood Markets Inc. (HOOD) closed nearly 5% higher on Wednesday and traded over 13% higher in Thursday’s pre-market session after the financial services company reported a billion dollars in quarterly revenue for the first time.

Revenue rose 115% year-over-year (YoY) to $1.01 billion during the fourth quarter compared to a Wall Street estimate of $951.79 million. Earnings per share (EPS) came in at $1.01 versus an analyst estimate of $0.45.

The company reported a net income of $916 million during the quarter, including a $369 million deferred tax benefit, primarily from the release of the company's valuation allowance on most of its net deferred tax assets. It also includes a $55 million benefit from a reversal of an accrual as part of a regulatory settlement.

In the same quarter a year ago, Robinhood's net income stood at $30 million.

However, the highlight of the earnings was the 200% jump in transaction-based revenues to $672 million, primarily driven by a 700% surge in cryptocurrency revenue to $358 million.

Options revenue rose 83% to $222 million, and equities revenue increased 144% to $61 million.

The company’s net interest revenues rose 25% YoY to $296 million, primarily driven by growth in interest-earning assets, partially offset by a lower federal funds rate.

During the quarter, Robinhood witnessed an 88% jump in assets under custody (AUC) while net deposits rose 49% to $50.5 billion.

For the full year 2024, total net revenues increased 58% YoY to $2.95 billion, and net income increased $1.95 billion to $1.41 billion versus a net loss of $0.54 billion in 2023.

CFO Jason Warnick said Q4 was a record-breaking quarter that capped off a record-setting year in 2024.

“For both the quarter and full year, we reached new highs for Assets Under Custody, Net Deposits, Gold Subscribers, Revenues, Net Income, Adjusted EBITDA, and EPS. We’re entering 2025 with strong momentum as we remain focused on delivering another year of profitable growth,” he said.

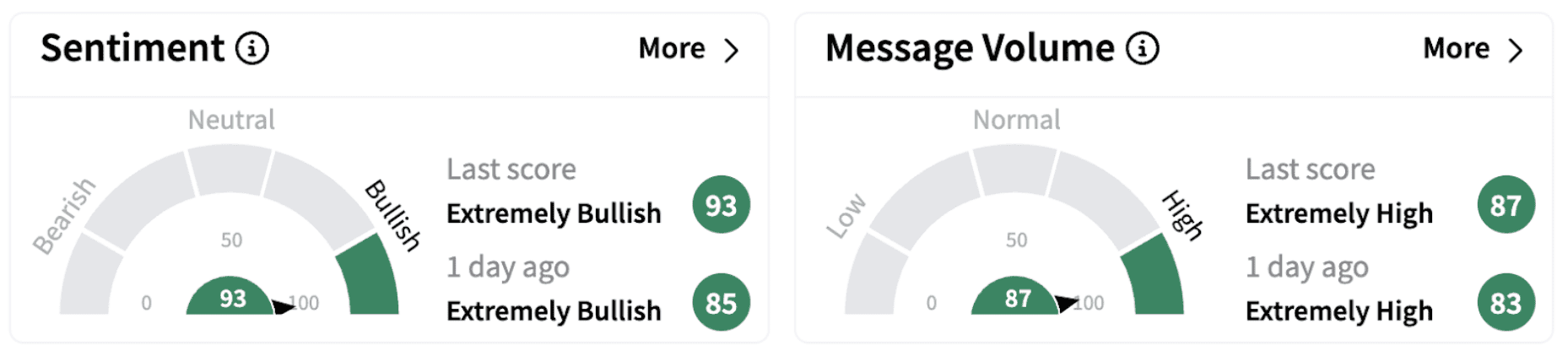

On Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (93/100), accompanied by significantly high retail chatter.

Most retail user comments on Stocktwits reflected a positive take on the stock’s prospects.

If Thursday’s pre-market gains hold, Robinhood stock will hit over 4.5-year highs recorded near its listing date.

Also See: Atlanta Fed’s Raphael Bostic Reportedly Says It’s Unclear When The Next Rate Cut Will Happen

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altimmune_jpg_8f251e2911.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)