Advertisement|Remove ads.

Wolfspeed Tanks After-Hours On Chapter 11 Bankruptcy Buzz: Retail Traders Pray For Meme Stock Miracle

Shares of Wolfspeed, Inc. (WOLF), a manufacturer of wide bandgap semiconductors, plummeted in Tuesday’s after-hours session amid reports of a Chapter 11 bankruptcy filing.

By late Tuesday, the 24-hour message volume on the Wolfspeed stream on Stocktwits jumped over 352%.

A Wall Street Journal report, citing people familiar with the matter, said the Durham, North Carolina-based company was eyeing a prepackaged bankruptcy filing within weeks. According to the report, most of the company’s creditors will likely support the proceedings.

The report also said the move may have been to tackle the upcoming debt maturities that could affect its ability to secure up to $750 million in government funding under the 2022 Chips Act.

The report said the company is required to refinance the 2026 convertible notes and the convertible notes maturing in 2028 and 2029.

With the company saddled with $6.5 billion in debt, far less than the $1.3 billion cash on hand, it negotiated an agreement with a group of investors led by Apollo Global Management for a $750 million financing in October.

Citing SEC filings, the Journal said the Apollo-led Group, which held about $1.5 billion in senior secured loans, has the right to approve any new secured financing. Apollo’s credit agreement also included a “make-whole” provision, allowing Wolfspeed to emerge from the bankruptcy largely intact.

Wolfspeed reportedly rejected a debt-holder proposal offered in March after Apollo objected to a restructuring deal that sought to convert some of the outstanding convertible notes and a loan from the company’s largest customer, Renesas Electronics.

According to Koyfin data, the stock's short interest is a hefty 43.20%. The report states that Wolfspeed remains the most shorted U.S. stock.

Incidentally, the company had sounded a “going concern” warning in its 10-Q report filed earlier this month.

A separate Bloomberg report said put options on WOLF surged in Tuesday’s regular trading session, even before the Wall Street Journal published its report. Data showed that 69,886 contacts of $3 put expiring in July exchanged hands mostly during the last hour of trading, with the corresponding underlying shares at 7 million. Total put volume surged to over 363,000 lots, with bearish bets making up the 10 most actively traded contracts.

If the after-hours declines are carried over to Wednesday’s regular session, the put holders will be in for huge profits..

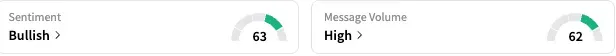

On Stocktwits, retail sentiment toward the Wolfspeed stock was ‘bullish’ (61/100) by late Tuesday, with the positive sentiment accompanied by ‘high’ message volume.

One bullish watcher said the stock could do with some “Roaring Kitty” support, referring to the meme stock investor behind the meme mania seen during 2021.

Another user expected a short squeeze on Wednesday.

Wolfspeed stock ended Tuesday’s regular session down 10.32% at $3.13, plummeting 60.08% in the after-hours session. The stock is down 53% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple Plans To Open Up Its AI Model To Third-Party Developers, Says Report

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)