Advertisement|Remove ads.

XPeng CEO Signals Aggressive R&D Push In 2026 After ‘Full Cycle’ Of Challenges

- He said the company has reached a new stage after building stronger internal systems in 2025.

- The focus is shifting toward delivering new technology tied to its longer-term Physical AI efforts.

- The comments come as XPeng reports improving financial trends and narrowing losses.

XPeng CEO Xiaopeng He said the electric-vehicle maker will step up its investment in research and development in 2026, framing the move as the next phase in a long technological journey after years of operational and financial challenges.

The company’s U.S.-listed stock fell nearly 6% to $20.7 on Wednesday.

In a post on X, He said XPeng has reached a “brand-new starting point” eight years after setting up its R&D center in Silicon Valley in 2017, describing the period since as a full business cycle marked by “real challenges.”

R&D Takes Center Stage After ‘Full Cycle’

Looking ahead, He said the company will “commit even more firmly to investing in R&D” in 2026, with a focus on delivering new technological innovations globally. He added that XPeng has begun to see early signs of “emergence” in its longer-term push toward Physical AI, without detailing specific products or timelines.

While the company did not outline a broader “physical AI” roadmap, XPeng has disclosed progress in autonomous driving and robotaxis, including plans to roll out a new driver-assist system capable of navigating narrow streets by early 2026 and launching three robotaxi models the same year.

Beyond these disclosed vehicle programs, Macquarie Capital said XPeng could expand into humanoid robotics and eVTOL aircraft, alongside AI semiconductors, though the company has not provided timelines or operational details for those initiatives.

The comments position R&D as the core driver of XPeng’s next phase, following what He described as organizational and system-level improvements made during 2025.

Financial Progress

The renewed R&D emphasis comes after XPeng reported its smallest quarterly net loss in five years in the third quarter. The company posted a net loss of 380 million yuan ($54.3 million), down sharply from prior periods, and said it was nearing profitability on an adjusted basis.

XPeng has now reported eight consecutive quarters of year-on-year net loss reduction, supported by record vehicle deliveries and rising service revenue. Third-quarter deliveries reached 116,007 vehicles, while revenue more than doubled from a year earlier to 20.38 billion yuan.

R&D spending itself increased during the period, with third-quarter expenses rising nearly 49% year over year to 2.43 billion yuan.

Tech Partnerships And Services

The company’s technology capabilities have also translated into higher-margin service revenue. XPeng said growth in its services and other business was partly driven by technical R&D services provided to an unnamed automaker following the completion of key milestones.

Service and other business margins reached 74.6% in the third quarter, underscoring the growing role of technology-related revenue alongside vehicle sales.

Alongside its R&D focus, XPeng has continued to expand internationally. The company now operates in more than 50 countries and has reported a 95% growth in overseas deliveries in 2025.

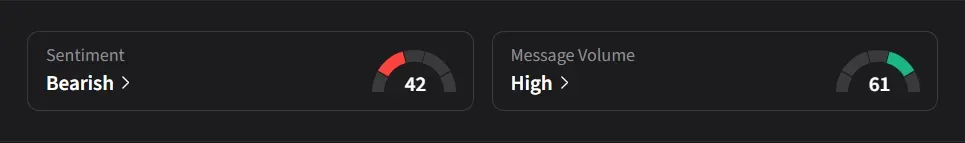

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for XPeng was ‘bearish’ amid ‘high’ message volume.

XPeng’s stock has declined 69% so far in 2025.

($1=7 yuan)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)