Advertisement|Remove ads.

Activist Investor Toms Capital Investment Management Buys ‘Significant Stake’ In Target: Report

- The hedge fund had previously invested in Kenvue ahead of its $48.7 billion sale to Kimberly-Clark last month.

- Target’s year-on-year sales have declined for the past four quarters, according to Koyfin data.

- Target last reported a double-digit sales growth in the third quarter of full-year 2021.

Retail giant Target Corp. (TGT) has reportedly come under pressure from an activist investor following a sharp decline in sales that has wiped out a significant portion of its market value this year.

According to a Financial Times report, activist hedge fund Toms Capital Investment Management (TCIM) has acquired a significant stake in the retailer. However, the exact size of TCIM’s position was not disclosed. The hedge fund had previously invested in Kenvue ahead of its $48.7 billion sale to Kimberly-Clark last month.

Target’s Declining Sales Momentum

The retailer has been under significant pressure lately, with year-on-year sales declining for the past four quarters, according to Koyfin data. Target last reported a double-digit sales growth in the third quarter (Q3) of full-year 2021.

In the last quarter, Target’s net sales declined 1.5% to $25.3 billion, with comparable store sales falling nearly 4%. Net earnings slumped 19.3% to $689 million, while management forecast a low-single digit decline in sales for the fourth quarter.

Earlier this week, Wolfe Research said that Walmart (WMT) continues to outperform Target across most trade areas. A recent website and app outage, along with regional distribution disruptions, led Wolfe to lower Target’s Q4 same-store sales estimate by 25 basis points, although no immediate out-of-stock issues were reported. The firm maintains an ‘Underperform’ rating with a price target of $81. This implies a 17% discount to the current price of $98.

Last month, RBC Capital said Target’s path back to growth “seems long”, with uncertainty around the level of reinvestment required. Michael Fiddelke, who is set to take over as the company’s CEO in February next year, plans to spend $5 billion in 2026 on store renovations, product refreshes, and digital improvements.

How Did Stocktwits Users React?

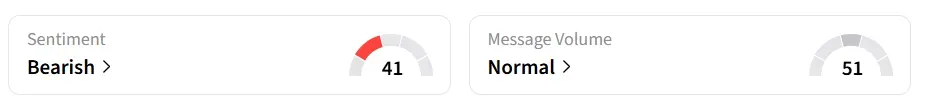

Retail sentiment on Stocktwits around Target trended in the 'bearish' territory at the time of writing.

One user highlighted the stock’s rebound from its 200-day moving average (200-DMA).

Another user expects the share price to climb to $105 next week.

Year-to-date, TGT stock has declined more than 27%. WMT stock has gained 24% while Costco Wholesale Corp. (COST) has declined 4.5% so far this year.

Read also: Aptevo Therapeutics Stock Slumps To All-Time Low On Reverse Split Approval

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)