Advertisement|Remove ads.

XPeng Stock Falls Premarket Following Tesla-Style Financing Rollout

- The financing push comes as competition intensifies among Chinese EV makers amid slowing demand and changing policies.

- Automakers are leaning on longer-term loans to lower monthly payments rather than cutting vehicle prices.

- The moves align with government calls to stabilize the market and avoid aggressive discounting.

XPeng shares fell over 2%% in premarket trading on Thursday, even after the Chinese EV maker rolled out a long-term financing offer in its home market, mirroring a strategy recently introduced by Tesla and quickly adopted by several rivals.

Seven-Year Financing Rolled Out

XPeng announced on Weibo that vehicles purchased between January 21 and January 31 will qualify for a seven-year low-interest financing offer on its entire lineup, according to a report by CnEVPost.

The deal applies to the Mona M03 electric sedan, which starts at 119,800 yuan ($17,210), allowing buyers to reduce monthly payments to as little as 1,355 yuan with a 15% down payment.

XPeng didn’t specify what the interest rate would be, but framed the offer as helping to reduce the upfront cost of ownership.

Tesla Sets The Template

XPeng joining the fray came days after Tesla said Jan. 6 that customers in China would be able to access seven-year ultra-long-term loans at lower interest rates for locally made cars.

Tesla said during the promotional period through Jan. 31, the financing would apply to its Model 3 and Model Y vehicles. It also marks the longest financing term any automaker has offered in China.

Tesla stated customers could save as much as 33,479 yuan while interest rates could be as low as 0.98% annualized. The electric vehicle maker is hoping the program will help soften the blow of China’s impending EV purchase tax, which starts in 2026.

Financing Replaces Price Cuts

The shift reflects growing pressure on automakers to stimulate demand without cutting sticker prices, as regulators push back against aggressive discounting across the sector.

On Jan. 14, China’s Ministry of Industry and Information Technology and other government departments held a symposium with new-energy vehicle companies, urging the industry to curb what officials described as “disorderly price wars.”

Following Tesla’s move, other automakers have quickly followed. Xiaomi’s EV unit announced similar incentives for its YU7 SUV on Jan. 15, while Li Auto introduced extended financing offers on Jan. 20.

Policy Backdrop Supports Consumer Credit

Chinese policymakers have doubled down on calls to increase financial incentives for vehicle purchasers and ease access to car ownership in recent months.

With national trade-in subsidies expected to remain on pause for now and purchase taxes slated to return in 2026, automakers are turning to extended low-rate financing to stand out in one of the most competitive EV markets globally.

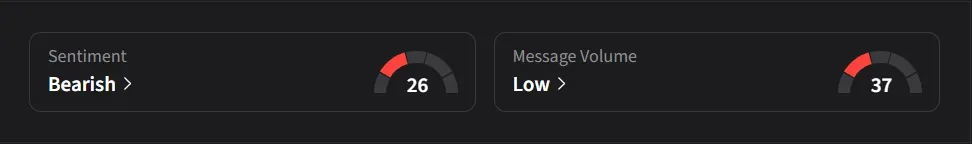

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for XPeng was ‘bearish’ amid ‘low’ message volume.

XPeng’s U.S.-listed stock has risen 36% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)