Advertisement|Remove ads.

XPeng Stock Gets Price Target Hikes From Macquarie, Bernstein, BofA After Upbeat Q1: Retail’s Cautiously Optimistic

Multiple brokerages, including Bank of America, raised their price target on shares of Chinese EV maker XPeng Inc. (XPEV) after the company’s first-quarter earnings exceeded Wall Street expectations.

Macquarie analyst Eugene Hsiao upgraded XPeng to ‘Outperform’ from ‘Neutral’ with a price target of $24, up from $22.

XPeng reported adjusted and diluted loss per American depository share (ADS) of RMB0.45 ($0.062) for the first quarter, compared with a loss of RMB1.49 for the first quarter of 2024, and below an estimated loss of RMB1.51 per share.

Hsiao noted that XPeng continues to execute ahead of expectations in a difficult domestic EV market and that strong launches of the M03 MAX and G7 could drive momentum in the upcoming quarters.

XPeng said on Wednesday that it expects to deliver between 102,000 and 108,000 vehicles in the second quarter, representing a 257.5% year-on-year (YoY) increase.

The company also sees Q2 revenue between RMB17.5 billion and RMB18.7 billion, representing a YoY increase of approximately 115.7% to 130.5%, above an analyst estimate of RMB17.22 billion.

Bank of America raised its price target on XPeng to $29 from $27 while keeping a ‘Buy’ rating on the shares and expressed optimism for the company’s upcoming vehicle launches.

Bernstein analyst Eunice Lee, meanwhile, raised the firm’s price target to $19 from $18 while keeping a ‘Market Perform’ rating on the shares.

Notably, XPeng has not turned a profit since its founding in 2014.

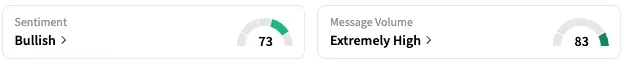

On Stocktwits, retail sentiment around XPEV fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours while message volume jumped from ‘high’ to ‘extremely high’ levels.

XPEV stock is up by about 80% this year and by about 138% over the past 12 months.

Also See: Vigil Neuroscience Stock Triples Pre-market On Acquisition By Sanofi: Retail Goes Super Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange Rate: 1 RMB = 0.14 USD)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)