Advertisement|Remove ads.

XPeng Launches MONA M03 Max With ADAS In $20,000 Price Segment, But Retail’s Not Super Excited

Chinese EV maker XPeng Motors (XPEV) launched the Max variant of its all-electric hatchback sedan MONA M03 in China on Wednesday, sending NYSE-listed shares of the company trading 1% higher midday.

The Mona M03 is priced under the $20,000 or RMB 150,000 segment in China. XPeng debuted the MONA M03 in August and started deliveries in September. The company has delivered 120,000 units of the vehicle as of May 2025.

With the launch of the MONA M03 Max variant, the company has introduced a city-level advanced drive assistance system (ADAS) to the $20,000 price point, XPeng said, adding that the ADAS system, called AI Turing Smart Driving, is the only advanced ADAS available in this price segment globally.

No added cost or subscriptions are required to access the company’s smart driving system, which can accurately detect over 50 road elements from traffic signs to complex obstacles, the company said.

The vehicle also features a smart cockpit with features outperforming higher-priced vehicles, as well as the previously launched MONA M03 variant, the company said. The Max variant offers two range options of 600 km and 502 km.

Earlier this month, XPeng reported first-quarter earnings that surpassed Wall Street expectations owing to strong vehicle deliveries of 94,008 units. The firm said it expects to deliver between 102,000 and 108,000 vehicles, representing a YoY increase of 257.5%, in the second quarter.

The company sees second-quarter (Q2) revenue between RMB17.5 billion and RMB18.7 billion, representing a YoY increase of approximately 115.7% to 130.5%.

XPeng is also looking to debut an all-new model called the XPeng G7 SUV in June in the RMB 250,000 SUV segment to increase delivery momentum.

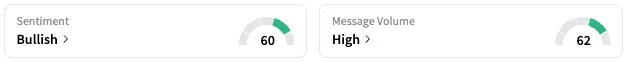

On Stocktwits, retail sentiment around XPEV fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours while message volume dropped from ‘extremely high’ to ‘high’ levels.

According to data from Koyfin, 20 of the 28 analysts covering XPeng rate it ‘Buy’ or higher, seven rate it ‘Hold’, while one rates it a ‘Strong Sell’.

The stock has an average price target of $25.03, representing an upside of over 25% from current trading levels.

XPEV stock is up by about 68% this year and 130% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_joblessclaims_resized_jpg_b395b1ff15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_cme_resized_5dbde36693.jpg)