Advertisement|Remove ads.

XPO Stock Rises After Q4 Profit Beat: Retail’s Elated

XPO shares rose 7.8% on Thursday after the company’s fourth-quarter earnings topped Wall Street estimates.

On an adjusted basis, the goods transport firm reported earnings from continuing operations of $0.89 per share for the fourth quarter, compared with the average analysts’ estimate of $0.63 per share, according to FinChat data.

Its quarter revenue declined 1% to $1.92 billion compared to the year-ago quarter. Wall Street estimated fourth-quarter revenue to be $1.92 billion.

The company attributed the decline to lower fuel surcharge revenue in the North American less-than-truckload (LTL) segment.

The LTL segment is a shipping service for comparatively smaller freight loads and helps minimize shipment costs.

The company’s North American LTL segment shipments per day declined 4.4% compared to last year, and the average load factor fell 1.9%.

However, its revenue per shipment rose 1%, including fuel surcharges.

Operating income rose to $179 million in the fourth quarter, compared with $149 million in the same period in 2023.

“We’ve entered 2025 with strong momentum, following landmark network investments that strengthen our competitive position in a freight market recovery and for the long-term,” CEO Mario Harik said.

The company said its European transportation segment revenue increased to $765 million for the fourth quarter, compared with $753 million in the year-ago quarter, primarily due to pricing growth.

The company expects gross capex expenditure to be between $600 million and $700 million.

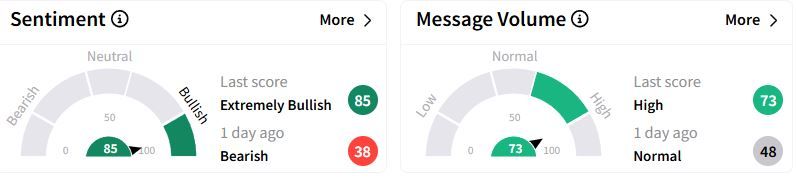

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (85/100) territory from ‘bearish’(38/100) a day ago, while retail chatter rose to ‘high.’

Over the past year, XPO stock has gained 50.62%.

Also See: ConocoPhillips Tops Q4 Earnings On Strong Oil Production: Retail’s Unswayed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)