Advertisement|Remove ads.

Zeekr Enters $2.4B Deal With Chinese Carmaker Geely To Go Private

China-based EV maker ZEEKR Intelligent Technology Holding Limited (ZK) on Tuesday announced that it has entered into an agreement and plan of merger with its majority shareholder and Chinese automaker Geely Automobile Holdings Limited (GELYY).

ZK shares were trading 0.11% lower in the pre-market session on Tuesday at the time of writing.

As part of the agreement, Keystone Mergersub Limited, an indirect wholly-owned unit of Geely, will merge with Zeekr, with the EV maker becoming a wholly-owned unit of Geely.

Zeekr shareholders will receive $26.87 in cash per Zeekr American Depositary Share (ADS) or 12.3 newly issued Geely Shares per Zeekr ADS, which will be delivered in the form of American depositary shares of Geely.

The per-ADS cash consideration represents a 3.4% discount to Zeekr ADS’s closing price on the New York Stock Exchange on Monday.

If all eligible Zeekr holders elect to receive cash consideration and the privatization is conducted entirely in cash, the total cash consideration payable by Geely will be $2.4 billion. The cash merger consideration will be funded through Geely's internal resources, or if necessary, debt financing.

As of Tuesday, Geely holds approximately 62.8% of the total issued and outstanding share capital of ZEEKR. If the merger is completed, it will result in Zeekr becoming a privately held company wholly owned by Geely, and the Zeekr ADS will no longer be listed on the New York Stock Exchange.

The merger is currently expected to close in the fourth quarter of 2025, subject to regulatory approvals.

Geely proposed to take Zeekr private in May, saying it believes the integration of Zeekr’s assets and resources will help enhance the competitiveness of its passenger vehicle business.

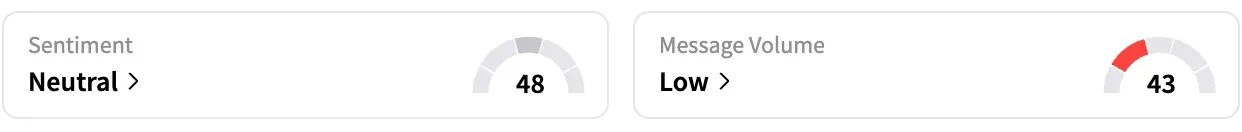

On Stocktwits, retail sentiment around Zeekr rose from ‘bearish’ to ‘neutral’ territory over the past 24 hours while message volume stayed at ‘low’ levels.

ZK stock is down by 2% this year but up by over 46% over the past 12 months.

Read Next: Apple iPhone Shipments Rose 1.5% in Q2, China Downturn Offset By Growth In Emerging Markets: IDC

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)