Advertisement|Remove ads.

ZIM Stock Rises After Signing Long-Term Charters For LNG Container Vessels, Retail Stays Bearish

ZIM Integrated Shipping (ZIM) stock rose 2.3% on Monday after it signed long-term charter agreements for ten liquefied natural gas (LNG) dual fuel container vessels for $2.3 billion.

The container vessels, each with a capacity of 11,500 twenty-foot equivalent containers, will be built at Zhoushan Changhong Shipyard in China. Delivery is expected between 2027 and 2028.

The company said seven of the vessels would be chartered to ZIM by Containers Ventures Holdings Inc., an affiliate of the TMS Group, and three by a shipping firm affiliated with Kenon Holdings, Ltd., which was ZIM's largest shareholder until the end of 2024.

“Operating LNG capacity has proved commercially advantageous for ZIM, and we anticipate increased demand for environmentally friendly shipping options, making access to LNG capacity even more beneficial in the future," CEO Eli Glickman said.

Companies worldwide are attempting to curtail emissions to comply with their net-zero goals. Container shipping accounts for about 3% of global greenhouse gas emissions.

The International Maritime Organization has set a goal for international shipping to cut emissions by at least 20% by 2030 from 2008 levels.

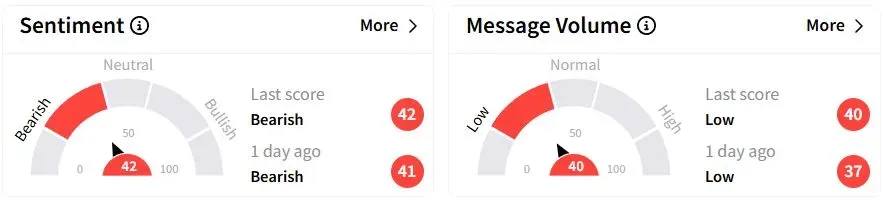

Retail sentiment on Stocktwits remained in the ‘bearish’ (42/100) territory, while retail chatter remained ‘low.’

One retail trader said the stock offered a “very rare” dividend yield, yet the market keeps “beating down this value stock unjustifiably.”

Another retail trader suggested the stock was heading down to $7.

Last month, the company projected 2025 adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) between $1.6 billion and $2.2 billion, based on the assumption that trade conditions in the Red Sea will not normalize until the second half of the year at the earliest.

ZIM shares have fallen 41.6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)